‘No talks’ at Whitbread

The wind was knocked out of Whitbread’s sails yesterday after chief executive Alan Parker moved to quieten the takeover talk that has buoyed its shares.

The leisure group was one of the biggest fallers of the day after Parker said there had been “no talks” with private or trade buyers about selling off any of the pub-to-health club business.

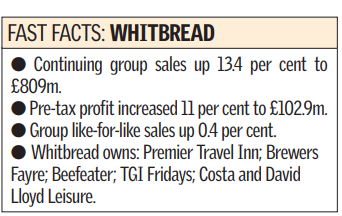

“If we had anything to say with regard to any takeover discussions we would have made an announcement,” said Parker. Instead he laid out a pared down vision to “drive improved performance” from the disparate group that included the predicted cull of 250 staff at its Luton headquarters. The move is expected to deliver £25m of annual savings by 2007/8 for an outlay of £25m. He also pledged to return an additional £400m to shareholders via a share buy back that commenced yesterday. Whitbread reported an 11 per cent increase in pre-tax profit to £102.9m from continuing operations in the six months to 1 September. Sales increased 13.4 per cent to £809.1m. Group like-for-like sales were flat at 0.4 per cent.

A strong performance from budget hotels chain Premier Travel Inn, where like-for-like sales rose 7.7 per cent, compensated for weakness in pub restaurants such as Beefeater and Brewers Fayre and the David Lloyd Leisure business. The performance of the high street division was mixed with aggressive expansion laid out for Costa Coffee — 100 new outlets this year — while sales at TGI Fridays and Pizza Hut were “disappointing.” TGI Fridays attracted more customers but is yet to recover from lower prices.

The group sold its Marriott hotels business for £1bn and the Chiswell Street brewery site for £55m. It returned £400m to shareholders by special dividend. The disposal of the franchised Marriott hotels stoked takeover speculation as it was seen to have been the “poison pill” that would block any deal. Broker Numis said it could only see the upside for investors. “We believe someone is going to unlock the inherent value in this group.”