No Christmas cheer for struggling high streets

HIGH street stores are failing to benefit from stronger economic confidence and higher consumer spending in the run up to Christmas, with footfall below last year’s level.

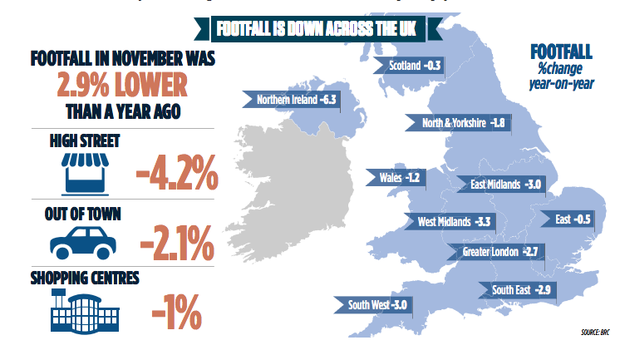

According to worrying figures released this morning by Springboard and the British Retail Consortium (BRC), high street footfall this November was down 4.2 per cent on the same month last year, with a 2.9 per cent drop across retail outlets as a whole.

Out-of-town stores and shopping centres got off more lightly than high streets, but foot traffic was still down by 2.1 and one per cent respectively on last year’s figures.

It is the fourth month that retailers have recorded a drop in footfall from the same month last year, with high streets facing larger drops this autumn.

“The last time footfall dropped by a similar magnitude in the build up to Christmas (2.8 per cent in November 2010), it was then followed by a decline in footfall of 8.8 per cent in December due to major snowfall,” said Diane Wehrle, Springboard’s retail insights director.

“It doesn’t appear that there is any one particular region in the UK that performed well in November, with all regions recording a decline in footfall over the year.”

Greater London saw a slightly shallower drop in traffic than other regions, but still recorded a 2.7 per cent decline. The sharpest contraction was posted in Northern Ireland, with a 6.3 per cent fall in shoppers.

According to previous data from the BRC, over half of the growth in non-food sales during the past 12 month has come from online transactions, limiting the scope for expansion among traditional retailers that do not have a strong online presence.

Figures released last week also confirmed that high street prices are still deflating, down 0.3 per cent in November compared to the same month last year, putting more pressure on retailers. Prices have fallen year-on-year in every month for the past seven.

The report adds fuel to Deloitte’s prediction that sales growth this Christmas would be driven by online shopping, with only a below-inflation hike forecast for physical retailers.