Next cautious after half year sales fall 6 per cent

Next, the second largest clothing retailer in the UK, saw sales fall in the first half of the year and said the trend was likely to continue this year.

Second quarter sales actually fared better than expected, down 2.4 per cent on the same quarter the previous year, as the warmer summer weather coaxed shoppers into spending. But a 9.4 per cent fall in first quarter sales led to a 6 per cent drop in first half like-for-like sales overall.

“We anticipated a tough season and managed stock accordingly,” the company said in a first half trading update yesterday.

The company said there was less stock going into the end of season sale but it slashed its sales prices to encourage shoppers to spend.

“We remain very cautious about the outlook for the second half and can see no reason for any improvement in consumer spending. Indeed, the economic risks appear to us to be on the downside,” Next added.

It believes that the soaring costs of food, fuel and mortgages will “weigh heavily” on its customers and as a result expects retail full price like-for-like sales in the second half of the year to be down by a similar amount to that of the first half.

Blue Oar Securities analyst Ian Macdougall retained his buy recommendation on the stock, saying Next was “likely to manage its way through the downturn better than many.”

Landsbanki and KBC Peel Hunt retained their hold recommendations given Next management’s cautious outlook.

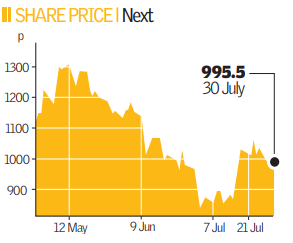

The retailer’s shares fell 3.38 per cent to 971p, giving it a market capitalisation of £1.98bn.

Analysts Views: What do you think of Next’s trading update?

Sam Hart (Charles Stanley): “The shares look very cheap, but the possibility of further deterioration in the consumer environment and margin pressure from textile price inflation, means forecast risk remains on the downside. There appear to be few obvious catalysts for a re-rating in the near to medium term.”

Nick Bubb (Pali International): “Next is managing the retailing downturn very well (better than M&S), but given the increasing economic pressure on Next’s customer base and a slightly fragile balance sheet, post the share buyback, the stockmarket is right to be wary. This may be about as good as it gets.”

Keith Bowman (Hargreaves Lansdown): “The update was broadly in line with the consensus and the fact that it met the guidance provides some confidence. Management is reasonably confident that it won’t have to change its full year guidance. The stock has declined 40 per cent in the last 12 months.”