New York, London and LA top list of most resilient cities while Scandinavia dominates ESG rating

The most resilient cities in the world have been named as New York, London and Los Angeles, with Scandinavia dominating environmental and social governance.

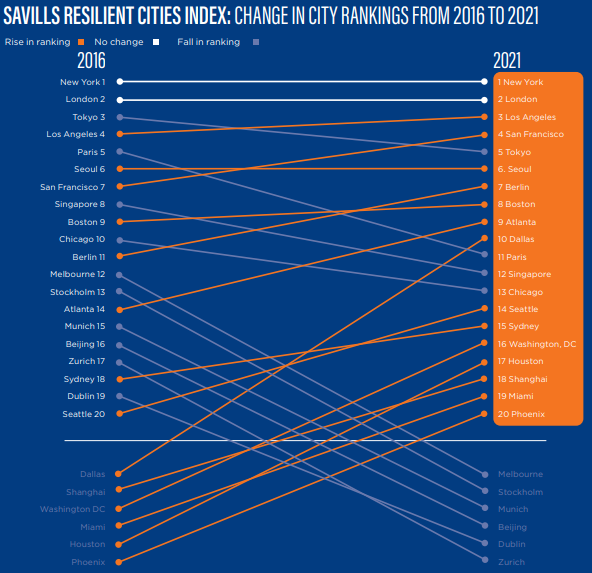

New figures from Savills highlighted how new population centres such as Berlin and Atlanta broke into the top 20 for the first time, but traditionally strong metropolises weathered the pandemic the best.

Manhattan came out as number one in the 2022 Impacts programme, examining more than 500 cities across the globe with metrics including economic strength, ESG (environmental and social governance) and real estate investment.

The top five was completed by San Fransisco and Tokyo, with LA proving the most resilient city for investment, moving ahead of New York.

London moved from third down to seventh in real estate investment, while no cities from Asia Pacific appear in that segment – but their strong performances in other areas ensured Seoul, Singapore, Sydney and Shanghai are all in the top 20 of the overall list.

When it came to ESG, Scandinavian hubs dominated with Norway, Sweden, Finland, Denmark and Iceland comprising the top five countries.

“The economic clout of the world’s biggest cities, combined with the strength of their talent bases and tech sectors, form a virtuous circle to attract real estate investment and help keep New York, London LA, San Francisco and Tokyo at the top of our Index”, said Paul Tostevin, director in Savills World Research.

“But many smaller cities are catching up and attracting talent and investment based on their bespoke strengths”.

He added that “the entire population of the top 10 cities for ESG is less than seven million and they’re all concentrated within Scandinavia, Austria and Canada,” providing a blueprint for the future, “which may become ever-more attractive to footloose professionals”.

According to Rasheed Hassan, Head of Global Cross Border Investment at Savills the world’s cities attracted record real estate investment in 2021 of $1.3 trillion transacted, 59 per cent up on 2020 and more than a fifth up of 2019

“Going forward, we expect that the biggest cities will continue to attract significant volumes, particularly in core sectors which are considered safe havens in times of uncertainty.”