New scheme set to make bank switching easier

Liam Ward-Proud looks at the accounts offered by the bigger challenger banks

FROM Monday, the Payments Council’s new seven-day switch guarantee scheme is set to make moving your bank account easier. It will ensure that bank account changes are completed smoothly and within a week, with transferring direct debits and incoming payments now the responsibility of the bank rather than the customer.

INDUSTRY SHAKE-UP

In 2012, Barclays, Lloyds, HSBC and RBS held 85 per cent of UK current accounts. The new scheme aims to increase the number of people switching, increasing competition in the sector.

Michael Ossei of uSwitch.com says that “the market share of the relaunched TSB, as well as Santander, Halifax and a range of smaller challenger banks is likely to improve as a result of the changes, with 42 per cent of customers saying they would be more inclined to switch under the new scheme.” Such banks are aggressively targeting potential switchers, offering a range of enticing offers for new customers.

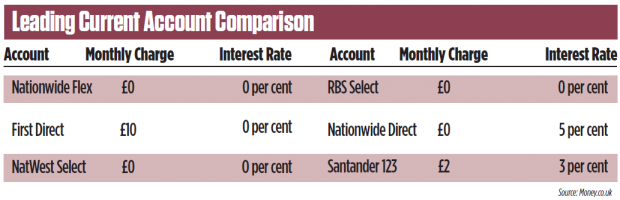

“The Santander 123 account is the standout for me,” MoneySavingExpert’s Dan Plant says. With a minimum £500 monthly funding, and a £2 per month account charge, the bank offers up to 3 per cent interest for balances between £3,000 and £20,000 and up to 3 per cent cashback on bills paid by direct debit. The Halifax Reward offers a £5 cash bonus each month (after tax) as long as the account stays in credit, and a £100 joining bonus if £750 is paid in each month. Black highlights the Metro Bank current account. Although paying no interest, it offers free card use abroad (many banks charge around 2.75 per cent per transaction), and has branches open seven days a week.

WIDER CONSIDERATIONS

For those also seeking a savings account, Ossei says, “it may be a good idea to look at some of the lower interest current accounts, as they sometimes offer high interest savings account as an addition.” The M&S Premium account, despite paying no interest and costing £15 a month, opens up access to the Monthly Saver account, which offers a highly competitive 6 per cent interest rate for savings of up to £250 a month for 12 months.

But financial incentives are not the only thing to consider. With base rates low at 0.5 per cent (and looking set to stay that way given the Bank of England’s new forward guidance policy), interest payments on current and savings accounts will be relatively small for most.“It may be worth foregoing a few pounds each month to switch to a well-liked bank,” he says. The bigger challenger banks are performing well, with 75 per cent rating Santander’s service as “great”, and Halifax’s at 56 per cent. First Direct, meanwhile, tops the customer satisfaction chart, with 93 per cent rating it as “great.”