Nearly every sector of UK economy powers away from feared recession

Nearly every sector of the UK economy is powering away from a recession that was much-tipped at the turn of the year, a new survey out today shows.

Some 11 of the 14 sectors monitored by Lloyds Bank are producing more than they did a month ago, the highest number in nearly a year.

The figures crystalise opinion switching from Britain slipping into a long recession to the economy holding up reasonably well.

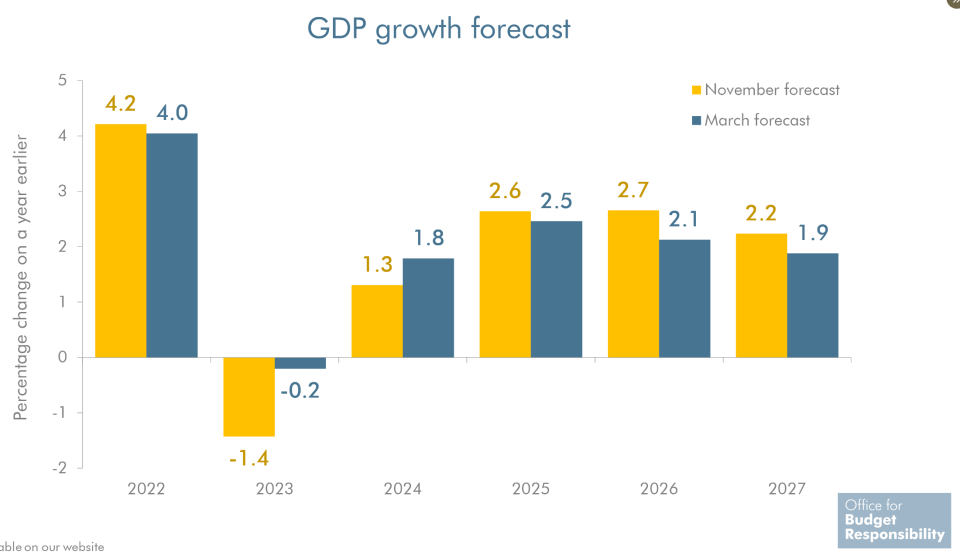

Instead of sliding into recession, the UK economy is likely to undergo a sustained period of stagnation after a mild blip this year, repeating its underperformance in the years after the 2008 financial crisis.

At the turn of the year, experts including the Bank of England and International Monetary Fund were warning the UK was on track for a much tougher short-term slump.

UK is not longer tipped to fall into recession

However, stronger than expected consumer spending, alongside measures taken by Chancellor Jeremy Hunt to boost business investment with tax reliefs, is expected to drag economic growth away from those dire forecasts.

The UK is still the only country in the G7 to not reach pre-Covid GDP levels and is still likely to clock the worst growth in the group in 2023.

“February’s data underlines the economy’s relative robustness, and gives some reasons for optimism for the year ahead,” Jeavon Lolay, head of economics and market insight at Lloyds Bank Corporate and Institutional Banking, said.

Technology equipment makers were the fastest growing of any business, with the sector’s index hitting 63.6 points, up from just under 50 points in the previous month.

Softer rises in business costs and a demand boost lifted economic activity last month, Lloyds Bank said.

Firms stepped up hiring for the first time in three months, signalling labour demand is still high despite the economic slowdown.

“While inflationary pressures are still acute and households continue to be cautious with spending, a healthy labour market is helping underpin confidence and demand,” Lolay added.

High demand for workers has waded against weak supply, pushing wages higher, raising the risk of further rate hikes by the Bank of England.

Wages have trailed inflation for 15 back-to-back months.

Bank Governor Andrew Bailey and co are expected to look through jitters about the health of the global banking system, sparked by Credit Suisse being hauled off to rival UBS in a shotgun sale over the weekend, and raise borrowing costs for the eleventh time in a row to 4.25 per cent.