Nationwide: House prices fell nearly 2 per cent in 2023 as higher mortgage costs bite

House prices in the UK fell 1.8 per cent over the course of 2023, according to the latest data from the Nationwide House Price Index.

The dip left the average cost of buying a home almost 4.5 per cent lower than the all-time high recorded in late summer 2022.

Prices were flat month-on-month, with the standard home costing £257,443 in December, compared with £258,557 in November.

Housing market activity has been weak throughout 2023, never really recovering from former prime minister Liz Truss’s disastrous mini-budget. The total number of transactions over the past six months was around 10 per cent below pre-pandemic levels, with those involving a mortgage down around 20 per cent, reflecting the impacts of higher borrowing costs.

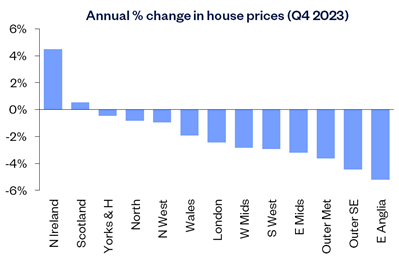

Over the fourth quarter of 2023, house prices declined in all but two areas of the UK.

Northern Ireland was the strongest performer with a 4.5 per cent rise, while East Anglia saw the biggest drop, with prices down 5.2 per cent year-on-year. London remained the most expensive region, with prices at £515,132, down 2.4 per cent.

Robert Gardner, Nationwide’s chief economist, said: “Even though house prices are modestly lower and incomes have been rising strongly, at least in cash terms, this hasn’t been enough to offset the impact of higher mortgage rates, which in recent months were still more than three times the record lows prevailing in 2021 in the wake of the pandemic.”

However, Nationwide’s Index suggested there were “encouraging signs” emerging for potential buyers moving into 2024 as inflation and interest rate expectations moderate.

Still, Gardner said: “a rapid rebound in activity or house prices in 2024 appears unlikely.”

He added: “While cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, consumer confidence remains weak and surveyors continue to report subdued levels of new buyer enquiries.”

Stephen Perkins, managing director at Norwich-based Yellow Brick Mortgages, said: “December is usually quiet but the first three weeks of this month saw buyers emerging left, right and centre. Demand was much higher than usual and did not drop off as early for the festivities as in previous years.”

Positive inflation data in December and now-expected rate reductions “could help rejuvenate the housing market in early 2024 as lenders should be confident to reduce their fixed rates in a January sale,” Perkins added. “Yes, a rapid rebound in prices is unlikely but consumer confidence is getting stronger by the day.”

Emma Jones, managing director at Frodsham-based Whenthebanksaysno.co.uk, said: “This has been no ordinary December, with demand remaining high right until the last few days before Christmas.”

“For now, buyers are still holding the cards but this may change in the months ahead if mortgage rates continue to tumble.”