National Grid profits slip near 20 per cent as chief slams government inaction

National Grid has called for policy to keep up with the company’s push to electrify the country’s grid, after hiking its spending to record highs over its first six months of trading this year.

Chief executive John Pettigrew urged the government to match investor appetite with measures to boost electrification and green spending.

He said: “Whilst we’re pleased to see momentum around policy reform on both sides of the Atlantic, we now look forward to seeing announcements and consultations translated into decisions and action in order to deliver the energy transition. We’re ready to meet the opportunities, and are set up to tackle the challenges ahead, to deliver a clean, fair and affordable energy future for all.”

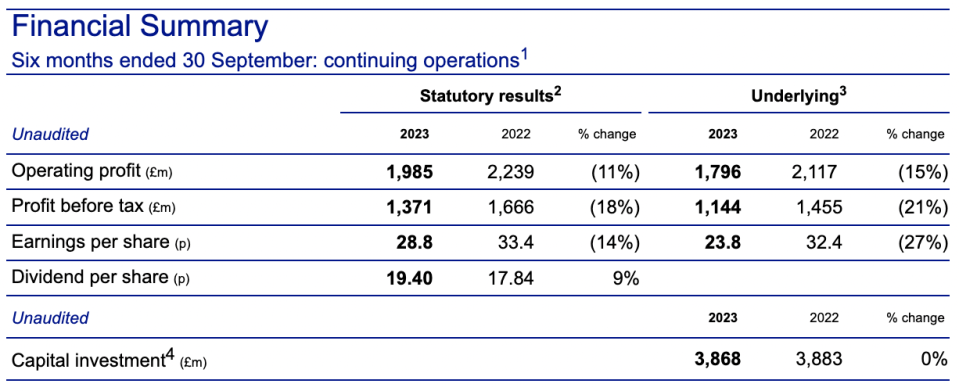

This comes with National Grid committing £3.9bn to boosting operations – including £3.5bn upgrading the grid – a rise in spending of ten per cent year-on-year, according to its latest half-year results.

Capital investment was chiefly driven by a higher connections spend and early investment relating to its electricity transmission businesses.

Nevertheless, National Grid’s pre-tax earnings have dipped 18 per cent from £1.67bn to £1.37bn year-on-year, while operating profits have slide 11 per cent from £2.24bn to £1.99bn over the same time period.

It argues performance is in line with expectations with earnings dented by non-recurring costs such as a two month contribution it owed the Narragansett Electric Company (£53m), insurance costs from a fire at one of its interconnectors (£70m), and overheads from property land sales (£201m).

Reflecting its bullish stance, National Grid has hiked its five-year financial framework for the period 2020/21 to 2025/26.

It now expects to invest around £42bn, with outturn investment in the mid to high teens range.

The company has confirmed an interim dividend of 19.4p per ordinary share in line with expectations.

The results did not include its remaining 40 per cent stake in the gas network, with the group closing in on selling its remaining stake to a consortium led by Macquarie Asset Management.

National Grid is overseeing the electrification of the grid by 2035 – in line with government targets.

We now look forward to seeing announcements and consultations translated into decisions and action in order to deliver the energy transition…

John Pettigrew, chief executive, National Grid

This will enable the country to shift from fossil fuels to renewables and heat pumps – to strengthen supply security and reach the country’s climate goals.

With 85 per cent of the UK’s housing stock heated by gas and over 75 per cent of the UK’s energy needs still met by fossil fuels, the scale of this challenge is enormous.

It is also facing issues reforming its queueing system for projects, and from restrictive planning laws stalling installations.

National Grid is listed on the London Stock Exchange, and will begin trading this morning at 969.8p per share on the FTSE 100 this morning.

Investec has maintained a buy stance at 983p per share.

City A.M. has approached the government for comment,