National debt: Government must reform or things will ‘blow up’

Sooner or later the British government is going to face a reckoning on the national debt.

The Office for Budget Responsibility’s (OBR) latest report on debt sustainability makes clear that the government cannot keep increasing spending on public services in line with demand while also leaving the tax base unchanged.

That’s because demand on public services is going to rise steadily, largely due to the UK’s ageing population. The OBR projects that public spending will rise to 60 per cent of GDP, up from 45 per cent at the moment, whereas revenue will remain flat.

Under these assumptions – which reflect the government’s existing policies – national debt spirals to 270 per cent of GDP.

It is worth pointing out that this scenario is, in many ways, fairly optimistic.

For a start, it does not include the impact of possible unforeseen shocks – since they are impossible to forecast – but it seems a certainty that there will be some shocks between now and 2074 (just think about the past 15 years).

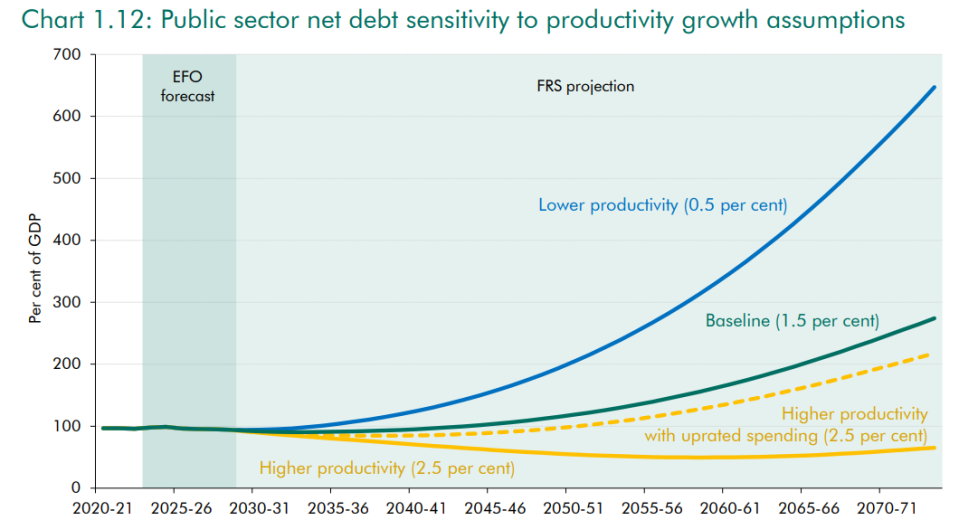

The OBR’s productivity forecasts are also relatively optimistic compared to many peers. If they prove to be overly optimistic, that will make a huge impact on debt (more on that later).

So, there’s good reason to think things could be significantly worse than the OBR’s main forecasts. Indeed, the OBR includes a forecast with added shocks which sees national debt rise to 300 per cent of GDP.

Don’t get lost in the numbers though. The entire point is that the government cannot keep on increasing spending without broadening the tax base. As David Miles, a senior official at the OBR, said, “at some point it will blow up”.

The central message of the report, then, is that the state has to reform.

The scale of required reform is large. Returning debt to its pre-pandemic levels would require tax increases or spending cuts worth around £40bn per decade over the next 50 years, the OBR estimates.

But there is also a get-out-of-jail free card: productivity growth.

Productivity, which measures output per hour, is the engine of economic growth. If productivity growth were to return to its pre-financial crisis levels – and the government used the proceeds to pay down debt – that would keep debt below 100 per cent of GDP for next 50 years.

The OBR has been overly optimistic on productivity growth for the past ten years, but it is a very difficult thing to forecast – particularly over the long run.

“Productivity growth tends to be generated by discovering new things,” Miles said. “If you knew the things that were going to be discovered in the future, you’d already discovered them. So, almost by definition, the main technological drivers of productivity growth are unforecastable”.

What should the government do?

So, where does that leave the government? Somewhere between a big rock and a very hard place.

Absent productivity growth, the government needs to close the gap between public spending and the tax take. That much is clear.

If a government opted to close the gap largely through spending cuts, then there would have to be significant improvements in public sector productivity to ensure the delivery of public services did not fall off a cliff.

But public sector productivity has been stagnant for the past twenty years. Gulp. This leaves “strict prioritisation” as the government’s only option, according to the OBR. This essentially means that the state will have to take on a significantly smaller role in the economy than it occupies now.

What about tax increases? The danger of closing the gap between the tax take and public spending purely through increasing taxes is that it could have a big impact on economic activity.

As Miles said: “One would be wary of thinking that you can increase the tax take year-after-year… without it doing some serious damage to the productive potential of the economy and the growth in productivity, which is the more painless way of closing the gap”.

It is open for debate how much more taxes can rise in the UK without having a big detrimental impact on economic growth, but there’s no doubt that at some stage it will have an impact.

Muddling through has been the preferred policy option over the past few years, but at some point, muddling through just won’t cut it any more.