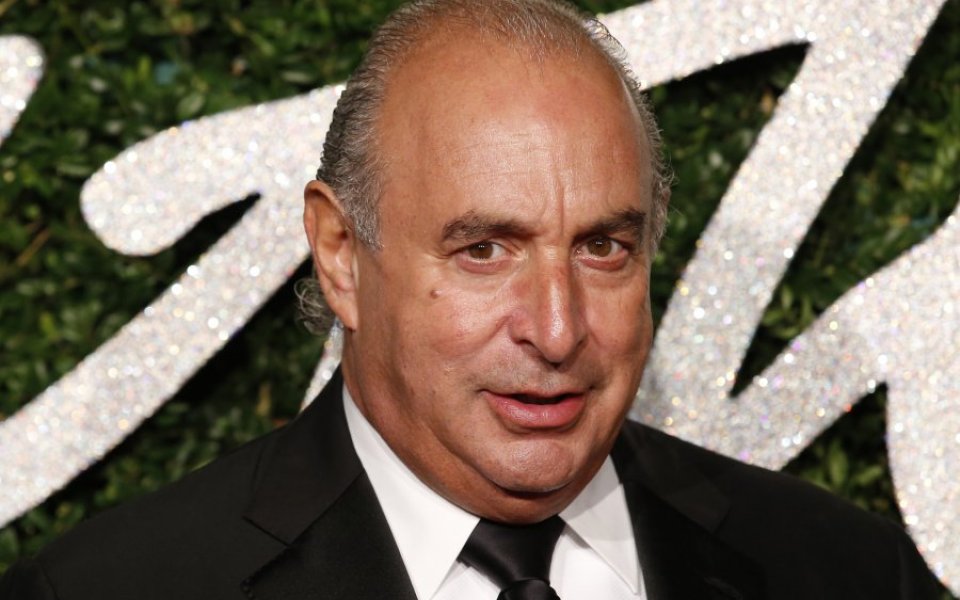

MySale shares jump as flash sales website backed by Sir Philip Green swings back into profit

MySale, the Australian flash sales website 25 per cent owned by Sir Philip Green's wife Tina, has swung back into profit in the first half after blaming marketing and expansion costs for posting heavy losses last year.

The UK-listed online fashion retailer, which operates in the UK, New Zealand, and Asia, as well as Australia, posted underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of A$1.5m (£730,000) in the six months to 31 December compared with a loss of A$11.4m last year.

Group revenue rose by four per cent to A$128.2m fuelled by south-east Asia, where sales grew by eight per cent.

MySale had a rocky debut on Aim in June 2014 after an error in its listing price caused the stock to slump by nearly one third, costing its backers Sir Philip Green and Sports Direct’s Mike Ashley millions of pounds.

The group then issued a profit warning just six months after its float, blaming a slowdown in its home market of Australia and New Zealand.

MySale’s share price has fallen by 80 per cent since its IPO. However, news of a return to profit cheered investors, with shares rising by more than five per cent today.

Chief executive, Carl Jackson, said: 'We have had a good start to FY16. In the first half we have seen improved trading in all our territories which is testimony to the focus and hard work of all our teams over the last 12 months."

“The board is confident the group is on track to meet its expectations for the financial year as a whole and we will continue to invest to drive growth,” he added.