MPC vote split three ways

A surprise three-way split between Bank of England rate setters left economists guessing whether an interest rate rise was on the cards.

The minutes of July’s Monetary Policy Committee rate contained the word inflation 54 times, which is higher than the average, according to Lehman Brothers, highlighting the MPC’s concerns about cost rises.

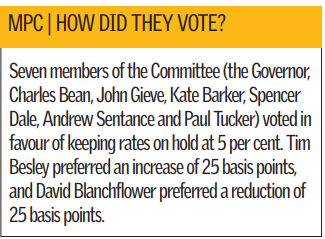

Seven members voted to hold the rate at 5 per cent, David Blanchflower voted for a 25 basis point cut, while Tim Besley voted for a 25 basis point hike. Besley’s move was unexpected by the consensus of economists, leaving analysts spilt over what the committee’s next move would be.

“The minutes of the July MPC meeting struck a slightly more hawkish tone than we had expected. There was a clearer discussion of the possibility of a rate hike, than a rate cut and concerns about the outlook for inflation were more apparent than those regarding the growth outlook,” said Lehman Brothers. It believes an August hike is possible. Meanwhile, the number of new mortgages approved for house purchases plummeted by more than two thirds in June compared to a year ago to hit a new record low.

Just 21,118 mortgages were approved last month, compared to 27,499 in May. The figures, from the British Bankers’ Association, are 67 per cent lower than in June last year.

The annual fall is the biggest since the series began in September 1997. Despite the decline in the number of mortgage approvals, total mortgage lending rose by £3.8bn in June.

This is an increase of 12 per cent on last year’s figures, although it is the weakest rise since October 2007. The BBA said the market was at its weakest since the early 1990s.