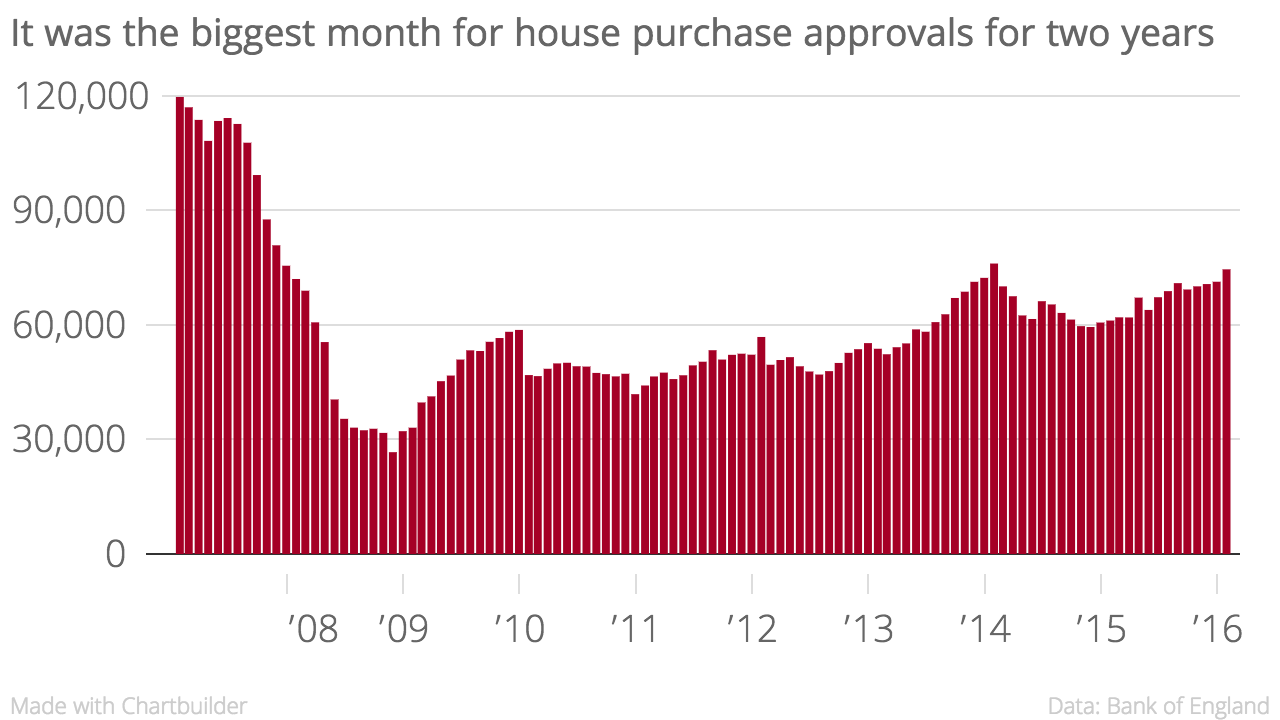

House purchase approvals hit two-year high as buy to let investors rush to beat April’s stamp duty change

Mortgage lending picked up in January as buy to let investors rush to buy properties before a hike in stamp duty in April.

Net mortgage lending rose to £3.7bn in January from £3.2bn in December, according to figures published by the Bank of England this morning.

There were 128,709 mortgages approved. Approvals for house purchase, as opposed to remortgaging, climbed to 74,581 – a two-year high.

"April’s increase in stamp duty on buy-to-let properties and second homes seem to be driving a rush to complete transactions. We would expect the February and March figures to be similarly strong, with activity then dropping off again once the new stamp duty rate is in place,” said Martin Beck, senior economic advisor to the EY Item Club, a group of economic forecasters.

“The Financial Policy Committee (FPC) has intimated that it is unlikely to intervene in the buy-to-let mortgage market until after it has been able to judge whether the Chancellor’s policy to increase stamp duty and change the tax relief for landlords on mortgage interest have been sufficient to cool the market. Therefore, we do not expect any action in this area at the FPC’s March meeting.”

“The Bank of England has expressed increasing concern about the frothiness of the lending data in recent months, so while the FPC may not intervene in the buy-to-let market, broader action is possible.”