Mortgage approvals collapse to early Covid-19 crisis levels after mini-budget chaos

Mortgage approvals in the UK have skidded to their lowest level since the early days of the Covid-19 crisis, pushed down by prospective buyers retreating after Liz Truss’s botched mini-budget sent interest rates flying, official figures out today show.

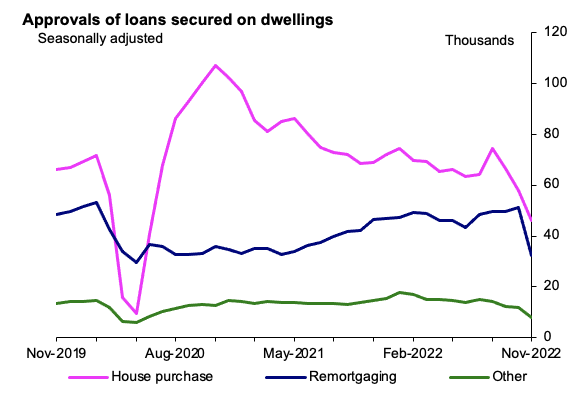

The number of mortgage approvals tumbled a fifth over the month to November to their lowest level since June 2020, down to 46,075 from 57,875, according to figures from the Bank of England.

That drop came before the Bank hiked borrowing costs 50 basis points in December, the ninth rise in a row. The central bank also lifted rates 75 basis points in November, the largest increase since the 1980s.

However, mortgage providers have been charging much higher rates than the benchmark after former Prime Minister Liz Truss’s botched mini-budget roiled financial markets.

Truss tried to push through £45bn of unfunded tax cuts despite inflation running at multi-decade highs, raising Britain’s borrowing trajectory. Investors responded by ditching UK bonds, sending yields sharply higher. Yields and prices move inversely.

That debt sell-off pushed the rate at which mortgage suppliers finance loans higher as well, prompting them to charge home borrowers more.

Now Chancellor Jeremy Hunt has since scrapped pretty much all of Truss’s tax cuts and launched £55bn of fiscal tightening in November, reassuring investors.

However, rates on typical mortgages have stayed above five per cent since Truss’s mini-budget, pricing prospective buyers out of the market.

Mortgage approvals have tanked

“The sharp fall in house purchase mortgage approvals in November comes as no surprise, given the tentative fall in quoted mortgage rates from October’s high levels and the withdrawal of some lenders in the wake of the mini-budget,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Experts reckon house prices are on track to stumble as much as 20 per cent in 2023 due to sellers having to drop prices to attract buyers who face the prospect of elevated mortgage bills.

Latest house price indexes from Nationwide, Halifax, Zoopla and Rightmove have all signalled house prices are softening.

Existing homeowners nearing renewing their mortgage may be forced to sell up as a result of being unable to swallow higher rates. The Bank of England reckons some mortgagors will have to absorb a £3,000 rise in their annual debt bill.

Brits tucked away £5.4bn in savings over the month to November, a slower inflow than in previous months, suggesting some are reducing the amount of cash they set aside each month to fund spending amid the cost of living crunch.

The slowdown in savings comes despite the Bank bumping rates aggressively, which should incentivise households to ferret away cash to capitalise on better returns.

Those without savings are seemingly turning to debt to support consumption, analysts suspect.

“The increase in the cost of living has driven consumer lending up in November with an additional £1.2bn of credit card borrowing,” Karim Haji, EMA and UK head of financial services at KPMG, said.

“Whilst this year’s Christmas discretionary spending will have been sacrificed, inflation on essentials and the increased cost of energy means debt is still being accumulated for food, lighting and staying warm.”

The likes of the Office for Budget Responsibility and other major UK economic institutions have assumed households will draw down their savings to support spending.

Even baking in that assumption, those organisations still think the country is on track for a recession. If Brits sit pat on their savings, the recession is likely to be much tougher.