More sectors flash recession warning amid spending cooldown

More sectors of the UK economy are flashing recession signals caused by consumers cutting spending in response to surging prices, a fresh survey published today reveals.

Some 11 sectors out of the 14 tracked by Lloyds Bank recorded a slump in both demand and output last month.

It is the fourth month in a row additional sectors have reported a slowdown in spending, indicating the cost of living crunch is weighing on businesses’ bottom lines.

Pubs, bars and restaurants notched the biggest drop in demand, suggesting cash-strapped Brits are ditching non-essential purchases as their budgets are squeezed by high inflation.

“The slowdown in activity spread to more sectors of the UK economy in August,” Jeavon Lolay, head of economics and market insight at Lloyds Bank, said.

Firms are grappling with soaring energy bills fuelled by the international energy market being jolted by Russia’s invasion of Ukraine.

Higher interest rates caused by the Bank of England trying to tame inflation are also crimping businesses’ finances.

New chancellor Kwasi Kwarteng this Friday is expected to outline more details on the government’s support package to help firms with their energy costs.

He is also likely to announce a reversal of the 1.25 percentage point national insurance rise and the six percentage point corporation tax increase.

Yesterday, the treasury select committee urged the government to instruct the Office for Budget Responsibility to produce forecasts to capture the policy changes impact on the economy.

A separate survey published today underscores the sharp blow rising prices have dealt to business confidence.

Some 79 per cent of small businesses think the UK’s current economic situation is worse than the pandemic, according to Bibby Financial Services.

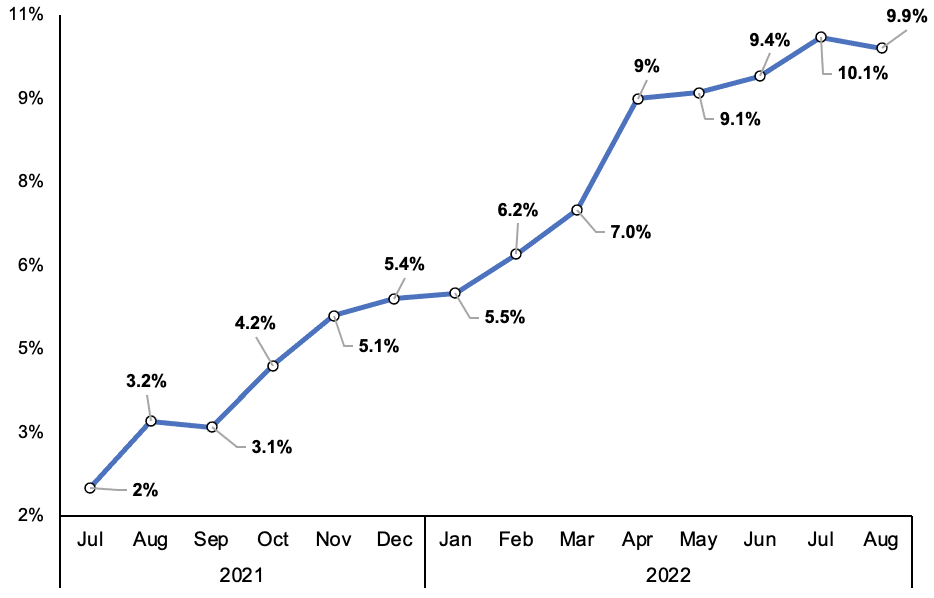

Most companies would rather two more Covid-19 lockdowns than another inflation, which is running at a near 40-year high of 9.9 per cent, surge.

Annual UK CPI inflation

“In the face of a near certain economic recession and spiralling costs, it’s life or death for many of the UK’s SMEs,” Derek Ryan, UK managing director of Bibby Financial Services, said.

Consultancy Oxford Economics also found nearly half of businesses around the world think the global economy will suffer a recession soon.