Monzo celebrates fourth year on top of bank satisfaction rankings

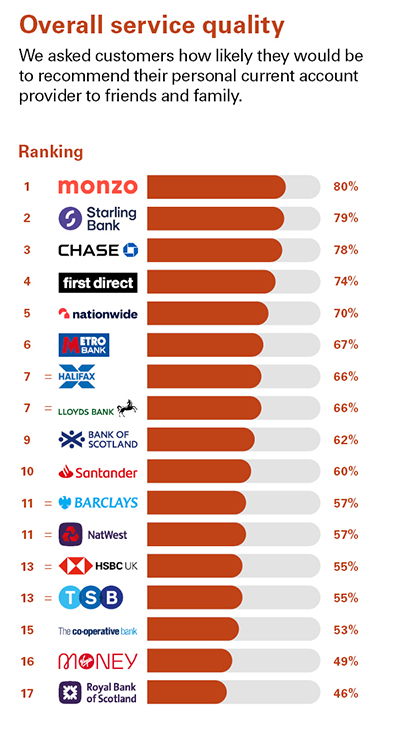

Monzo has once again taken first place in an official league table measuring whether customers would recommend their bank to friends and family, with the firm marking four years in the top spot.

The digital-only bank, founded in 2015, has topped the Competition and Markets Authority’s (CMA) biannual current account satisfaction ranking since August 2020, occasionally sharing the first-place spot with Starling Bank – which most recently came in second.

Monzo scored 80 per cent for overall service quality, based on a survey of around 1,000 customers in Great Britain by Ipsos. It also topped a separate league table for business banking with a score of 85 per cent, as well as Ipsos’ Northern Ireland personal banking survey.

“Topping these tables time and time again is recognition of the hard work and dedication of every employee at Monzo and something we’re incredibly proud of,” said Lyndsey Edgar, Monzo’s vice president of operations.

Starling scored 79 per cent for personal banking in Great Britain, also coming second for both business banking with 83 per cent.

JPMorgan-owned Chase UK, which entered the personal banking table for the first time, came in third with a score of 78 per cent.

The results underscore the booming popularity of digital challenger banks, which are growing their market share in both retail and business banking with slick, mobile-first offerings. Monzo said earlier this month that it had surpassed 10m personal customers, making it the UK’s seventh-largest bank.

The personal rankings saw established high street names once again fall towards the bottom.

Natwest-owned Royal Bank of Scotland (RBS) came in last (17th) place with a score of 46 per cent, below Virgin Money (49 per cent) and The Co-operative Bank (53 per cent) – both of which are set to be taken over by larger rivals.

Spokespeople for Virgin Money and Co-op Bank noted that their scores in both business and personal banking had increased from the previous ranking in February.

“Listening to our customers, we’re delivering ongoing investment to modernise and improve customer service across our portfolio of products,” Virgin Money commented.

“We strive to continually enhance our service levels to meet the needs of our customers,” Co-op Bank said.

RBS did not respond to a request for comment.

The CMA introduced its league tables in 2017 to encourage switching and improve customer service. Banks and buildings societies are required to display the results prominently in branches and online.

The surveys also score firms on online and mobile banking, overdraft and branch services and, for small and medium-sized businesses, the quality of relationship management.

“It’s important that banks listen to their customers and then provide services in a way that works for them,” said Dan Turnbull, the CMA’s senior director of markets.

“Strong competition is the most effective way to improve the customer service experience, and this survey provides the transparency that people need to be able to choose a new provider if they feel their bank is not up to scratch.”

Digital banks pip high street rivals once again