Mitigating litigation risk: The impact of corporate social performance factors

Much has been written on the merits of ESG investing strategies and their ability to deliver comparable, if not superior, performance to traditional benchmarks. A majority of institutional investors are motivated to employ ESG investing strategies because they believe ESG will improve risk adjusted returns1, yet the circumstances in which ESG leads to better outcomes are less well understood.

In a new paper in the CFA Institute Financial Analysts Journal, authors Daniel Fauser and Sebastien Utz from the University of St Gallen examine one particular channel through which ESG affects valuation, namely litigation risk. Fauser and Utz study the extent to which the number of past ESG controversies affect the likelihood of class action lawsuits. They also examine when class action lawsuits arise, whether good corporate social performance can moderate the impact of such litigation on company valuation.

Setting the scene

The investment landscape is replete with corporate malpractice and litigation examples, which can cost companies millions of dollars. Poor corporate social performance can manifest in lawsuits surrounding controversies such as managerial misconduct, executive compensation abuses, monopolistic behaviour, environmental misdeeds, lax disclosure practices, and others. Understanding when and to what extent such controversies will affect share prices can help investors better manage portfolio risks.

Corporate social performance cuts across environmental, social, and governance dimensions, such as the level of a company’s emissions, its pollution and waste management practices, human rights and labour standards, anti-corruption practices, and other governance issues. A key question for investors is whether having a good record on these issues can provide an insurance-like effect that protects valuations when controversies arise.

Diving into the data

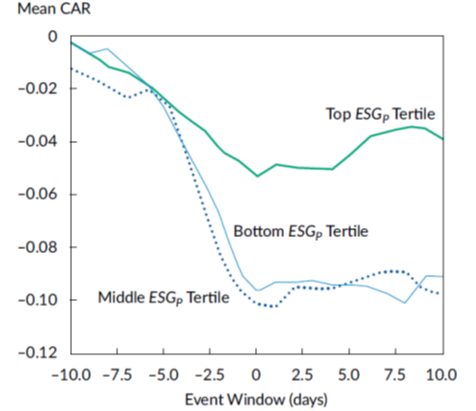

The research shows, first, that companies that experience fewer ESG controversies are less likely to face litigation in the form of class action lawsuits. Second, it examines the extent to which good corporate social performance creates an insurance-like effect that dampens the drawdown in share price performance when litigation does occur. In other words, to what extent does ESG performance build a “reservoir of goodwill” toward a company that limits the damage when lawsuits arise.

The research also shows that the top third of companies according to ESG performance suffer an approximately 4%-5% drawdown (controlling for other factors) in a period of 21 days around a class action lawsuit filing (day zero in chart). This outcome compares relatively favourably with drawdowns of approximately 10%-11% for companies outside the top third.

The implications of these results are that all else equal, portfolios with both high ESG scores and low exposure to corporate litigation can deliver outperformance.

The research adds another nuance to the analysis of ESG and performance, which continues to attract debate among practitioners. While previous research has shown mixed evidence on the link between ESG and performance, these latest insights inform our thinking about specific instances and sources of transmission through which ESG risks can affect returns.

The research also underlines the subjectivity of ESG data and analysis. Knowing which ESG data points are valid and material to the investment strategy and process is essential for unlocking value opportunities. As the number of ESG data sources proliferates, analysts must know what weight to assign to different data inputs and how to quantify the potential impact of certain ESG risk factors. The interplay between a company’s prior ESG record and its likelihood of being litigated adds another dimension to ESG analysis.

Further, investment managers that employ active ownership strategies could consider the implications for engagement with company management. Corporate executives would benefit from better understanding how ESG performance can create a moat of goodwill that can provide share price protection when controversies arise.

Conclusion

Overall, the findings can help both investors and company management better understand when and how ESG risks affect investment outcomes. It neatly illustrates the risk-mitigating properties of ESG performance. In doing so, it serves as a timely reminder of the importance of developing a richer understanding of ESG issues when constructing an investment strategy.

[1] Source: Future of Sustainability in Investment Management, CFA Institute (2020)

Image credit: ©Getty Images / sarayut Thaneerat