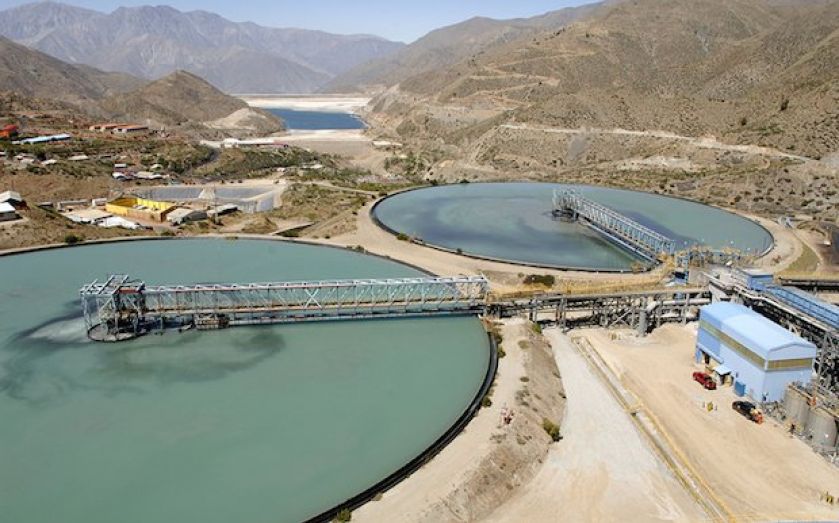

Miner Antofagasta hit by weak prices and high costs

Chilean-based miner Antofagasta has reported a 25 per cent fall in profit to $2.1bn (£1.3bn) in 2013, although it has pledged a much larger than expected dividend for shareholders. Shares have jumped almost six per cent this morning on the news.

Chief executive Diego Hernandez said the year was a challenging one, as the firm was hit by weaker commodity prices and higher costs, particularly when it came to energy. The copper specialist saw revenue fall 11.4 per cent to $5.9bn, as the copper price plummeted 10.6 per cent.

Net earnings were “further impacted” by the withholding of tax on the higher dividend pay-out, explained Hernandez. Earnings per share fell 36 per cent to 66.9 cents.

The FTSE 100 company saw record copper production in the year to 721,200 tonnes – a 1.6 per cent increase on 2012. This, is said, was mainly to higher plant throughput at its Esperanza mine.

Big dividend

The company's board is recommending a final dividend of 86.1 cents per share, from 12.5 cents in 2012. The return of surplus cash to shareholders sees the total dividend for the year come to 95.0 cents per share, although that's down 3.6 per cent on a year earlier. “This represents a total amount of $936.6m and a pay-out ratio of 142 per cent of net earnings”, Antofagasta said.

Numis has said that the earnings miss has been compensated for by the strong dividend, which was a big beat in terms of expectations. It’d forecast it to be maintained at 30 cents per share.

The big news, says Numis, is that Antofagasta is changing its dividend policy in a bid to simplify it and set a "minimum level of dividend relative to profits". From the statement:

The new dividend policy is to determine the appropriate dividend each year based on consideration of the Group's cash balance, the level of free cash flow and earnings generated during the year, and significant known or expected funding commitments and to pay a total annual dividend equal to at least 35 per cent of net earnings.

Outlook

Hernandez commented on outlook for this year, saying he expects it took look much like last year:

In this environment we are focused on resetting our cost base and optimising our operating assets, while continuing to invest in the future.

Looking ahead, we expect the operating environment in 2014 to be a similar to 2013 and we enter the year in a strong position. The changes we have put in place will continue to result in improved operational efficiency, our development projects are on-time and on-budget, and we are focussed on profitability and productivity across the Group.

Analysts have been weighing in on stock ahead of Antofagasta’s results. Credit Suisse reiterated its neutral rating on shares, with a $12.48 target price. Numis has reiterated its hold rating, target price of $11.64, and Investec has cut its target price to $12.52 from $12.71.