Mind the GAAP! The dangers of “growth at any price” stocks

Anyone who has ever taken a subway in New York City or frequented the London Underground will be familiar with the warning to “mind the gap” between the carriage and platform. In a similar fashion, investors also need to be fully aware of the dangers posed by the GAAP, or “growth at any price” stocks.

The acronym is a useful way to categorise a grouping of fast-growing companies which have performed exceptionally well over the past ten years. Think of the US technology businesses such as Tesla, Facebook, Amazon, Apple, Netflix and Google’s parent Alphabet.

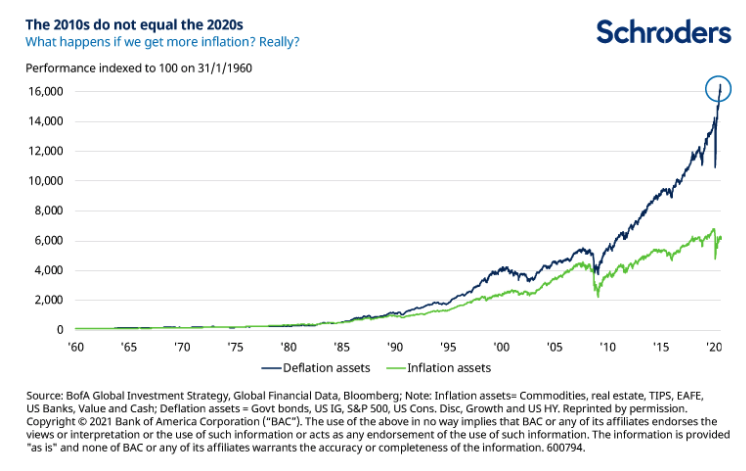

The GAAP is also the degree to which this group, along with other so-called “deflation assets”, has outperformed “inflation assets” over the past three decades. The disparity is clear to see in the chart below.

Past performance is not a guide to future performance and may not be repeated.

The chart compares the performance of a range of deflation assets, including government bonds, to the performance of inflation assets, such as commodities, real estate and high yielding stocks.

A shift in policy regime in the West accelerated by Covid-19 (coronavirus) is threatening to reverse the trend. The shift in regime has already led to a significant pick-up in expectations for future inflation, and volatility in US technology stocks. If this new regime results in a sustained return of inflation it will be crucial to “mind the GAAP”.

The GAAP is largely the result of low interest rates – it will matter greatly if rates follow inflation higher, as they always do.

Discover more from Schroders:

– Learn: The pros and cons behind the SPACs craze sweeping the market

– Read: The equity sectors best at combating higher inflation

– Learn: FOMO market is over – what next?

What has changed since the pandemic?

The coronavirus pandemic appears to have fundamentally shifted the way in which Western governments and central banks manage their economies.

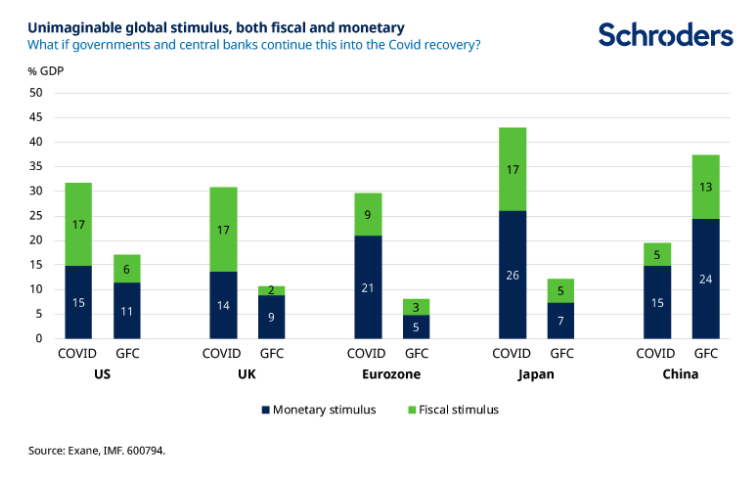

Fiscal policy – that is, governments regulating the pace of economic activity through taxing and spending – has made a dramatic comeback. We’ve seen vast outlays for businesses and households impacted by lockdowns. This is in stark contrast with the austerity measures imposed in response to the Global Financial Crisis (GFC) a decade ago.

It was clear even before coronavirus that addressing inequality with fiscal policy had moved higher up the political agenda than balancing the books. So, such expansive, inflationary policies may well outlive the pandemic.

Since the crisis, supporting economic growth, tackling inequality and other social objectives, such as greening economies, have converged under the political banner of “building back better”.

Successful policy co-ordination

Governments have not achieved the vast outlays in isolation. It has necessitated co-ordination with central banks, who have kept monetary policy ultra loose (see graphic, below). And, in further support of economic growth, central banks now seem prepared to let economies “run hot” at the expense of hard inflation targets.

The Federal Reserve, for instance, has signalled it will let US inflation exceed the previous target of 2% (now an average target), before raising base interest rates to moderate economic activity.

This is potentially a big break with the inflation targeting regime of the past 40 years. The shift in the way in which Western governments and central banks manage their economies could have a very different inflationary outcome to the one seen in the recent past.

Time for a change of approach

Given these changes we believe that the QARP approach, which looks for “quality at a reasonable price”, will be really important. This involves stockpickers identifying industry leading businesses that trade at attractive valuations.

These are well-managed businesses with a track record of strong and sustainable returns through various economic, or, industry cycles of the past, and stable earnings growth.

Many high quality UK-quoted companies continued to pay dividends last year. This was a clear vindication of the importance of quality (see: How finding the quality within value was crucial in 2020).

It’s also another reminder of why valuation and quality need to be viewed together. This will be key should there be a reversal of the trend for deflation assets to outperform inflation assets.

Furthermore, in the event of a sustained return of inflation, quality companies would likely be best able to raise prices, and/or cut costs. These are important considerations to mitigate the rising price of inputs such as raw materials, labour, and higher borrowing charges were interest rates to rise.

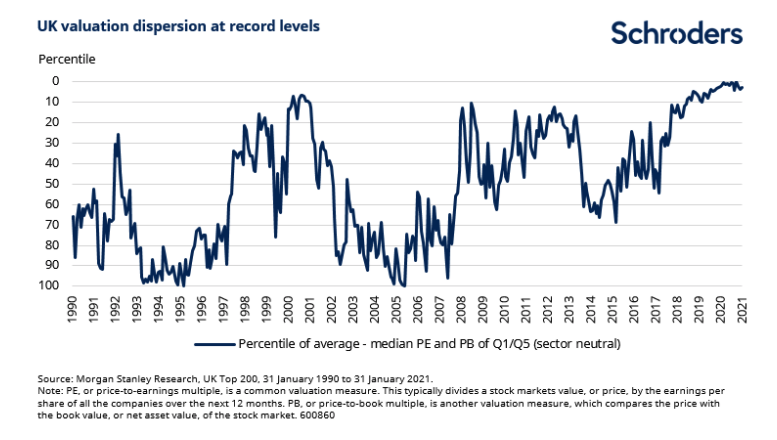

The degree to which deflation assets have outperformed since the GFC as a result of low inflation and rates should drive home the importance of not overpaying for stock. This can be appreciated by considering relative valuations.

How expensive are GAAP stocks?

Deflation assets such as GAAP stocks have become highly valued, in large part because of the significant cashflows they are expected to return to investors long into the future.

Interest rates are a key component of the “discount rate” at which an asset’s cashflows are discounted in order to compute their value in today’s money, or “present value”. For companies with cashflows further out, a lower discount rate enhances their present value by more.

After three decades of falling inflation and interest rates, deflation assets are now relatively expensive versus inflation assets, including commodities, real estate, and high yielding stocks.

How expensive? Well, for stock market investors “valuation dispersion” within stock markets is at record levels. Dispersion is a measure of the difference between the most highly valued and lowly valued stocks and is illustrated by the graph below for the UK.

On no occasion in the past 30 years has valuation dispersion within the UK stock market been higher than since coronavirus.

QARP helps in more ways than one

As future inflation expectations and market interest rates have risen in 2021, we’ve seen some deflation assets fall sharply (including the aforementioned US technology stocks) and inflation assets rise quite abruptly.

Investors have reappraised how they value investments on the basis on their sensitivity to higher rates. This is unrelated to the underlying prospects, or fundamentals of the individual companies.

We are not saying investors should avoid high growth companies, just to be sure not to pay for that growth at any price. This points to QARP. Additionally, the approach can also guide investors away from lowly valued companies whose prospects are poor.

Investors were handsomely rewarded in 2020 for correctly discerning between lowly valued UK financial and commodity companies with weak fundamentals from those with strong fundamentals. In other words, between big oil and banks which cut dividends, from insurers and miners which kept paying.

Like the subway announcements, the warning to mind the GAAP and focus on QARP is for investors’ own wellbeing.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.