Mike Ashley steps up involvement in Hornby with chief consultancy role

Mike Ashley has stepped up his involvement in model trains brand Hornby after becoming a consultant to its chief executive.

The billionaire majority owner of retail empire Frasers Group is to work with Olly Raeburn “in relation to systems, operations, logistics and, where relevant, broader matters of strategy”.

The appointment comes after Frasers Group, which owns the likes of Sports Direct and House of Frasers, significantly increased its stake in the Kent-based company last month.

The investment saw the group acquire more than 11m shares in Hornby, taking its total holdings to more than 15 million, or 8.9 per cent, to become Hornby’s third largest shareholder.

The acquisition of shares in Hornby was the latest such move by Frasers Group following its building sizeable stakes in fellow London-listed companies Currys, AO, N Brown, Boohoo and Asos.

Since Frasers Group increased its stake, Hornby’s market capitalisation has increased from just over £35m to more than £60m.

In a statement issued to the London Stock Exchange, Hornby said: “Further to the announcement dated 23 February 2024 giving details of Frasers Group plc as a strategic shareholder, Mike Ashley has entered into a consultancy agreement with Hornby through Mash Holdings Ltd (a company wholly owned by Mike Ashley).

“Mike will be available to support Olly Raeburn, CEO of Hornby, and the wider business, particularly in relation to systems, operations, logistics and, where relevant, broader matters of strategy.

“This approach is aligned to Fraser Group’s policy of partnering with strategic investments in order to add value for the respective shareholders of Hornby and Fraser Group.

“No remuneration is payable to Mash by Frasers or Hornby for these consultancy services.”

Earlier this month, Hornby napped up the assets, trade and intellectual property of The Corgi Model Club (CMC) from Blue 14, an investment vehicle majority-owned by entrepreneur Jim Lewcock.

More than 70 per cent of Hornby’s shares are held by Phoenix Asset Management Partners, with Artemis Investment Management the next largest shareholder on 16.2 per cent.

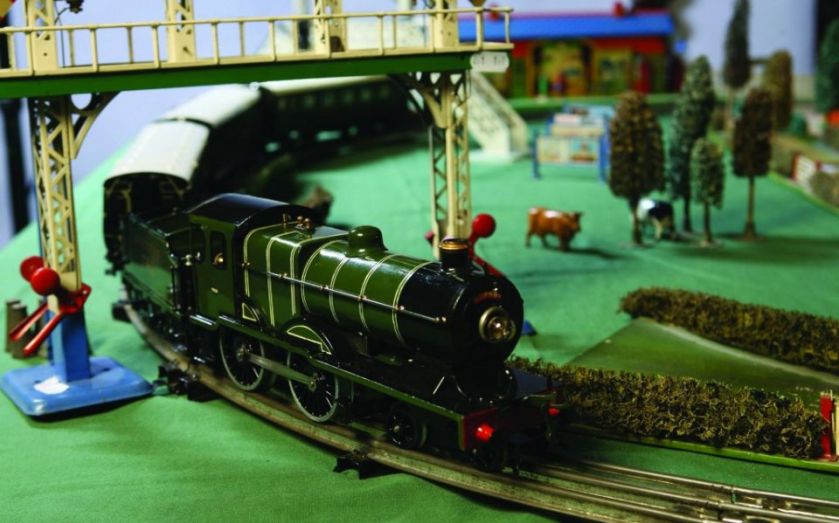

Hornby can trace its roots back to 1901 in Liverpool when founder Frank Hornby received a patent for his Meccano construction toy.

The company currently has a market capitalisation of more than £35m and posted revenue of £23.8m for the six months to the end of September 2023 and a pre-tax loss of £5m.