Midscale London hotels outperform cheaper rivals as back-to-the-office drives weekday bookings

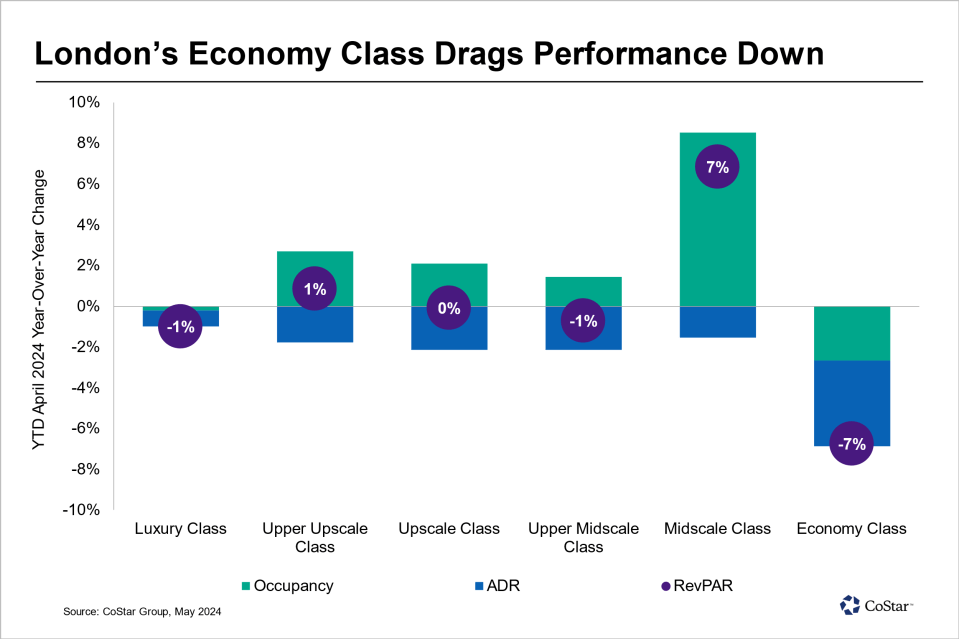

Midscale hotels are currently on top of the accommodation food chain in London, new data has found, as revenue available per room across the semi-affordable chains has risen seven per cent over the year to April.

The figures, published by CoStar and shared exclusively with City A.M., found demand was driven by customers looking for a room at a midscale hotel during the middle of the week.

Since the reopening of offices following the pandemic, commuters have been returning to the capital for business meetings and social events.

CoStar said revenue improvements have been occupancy-driven, “offsetting any losses in pricing”.

“Reductions in room supply have supported occupancy growth as demand softened in recent months, limiting revenue loss to some extent,” the firm said.

The health of the midscale market contrasts trends spotted in the more budget side of London’s hotel market.

At economy chains, revenue available per room was down seven per cent in the year to April. CoStar blamed increased supply compounded with softer demand patterns that may be affecting these hotels.

“From a consumer perspective, price sensitivity may also have influenced rate growth in recent months, with weekend pricing experiencing a seven per cent decline year over year, indicative of the leisure segment’s performance,” the firm said.

Cristina Balekjian, director of UK Hospitality analytics, said: “Overall, London hotel performance is expected to experience stable growth, which could impact hoteliers’ ability to drive profitability.

“The summer months are expected to be more robust, however. As of the end of May, occupancy on the books is trending about two percentage points ahead of last year’s performance, while market participants are also reporting stronger trading for the summer months, as events across the capital and the ongoing recovery of the international market support demand into London hotels.”

She added: “Nonetheless, some challenges are likely to remain. Pricing could be challenged, especially in areas and classes with greater additions to supply, while a more price-conscious and value-driven customer base could make competition tougher.”