Mid cap stocks gain favour as UK economic optimism rises

But don’t write off the more international FTSE 100 blue chips

THE UK recovery has finally taken hold. But not only is growth returning, many are now more optimistic about our economic prospects compared to other advanced nations. Last week, the OECD revised down its 2013 global growth forecasts to 2.7 per cent from 3.1 per cent, while upgrading the UK to 1.4 per cent. In 2014, it expects the UK economy to accelerate to 2.4 per cent, outpacing France (1 per cent), Germany (1.7 per cent), Japan (1.5 per cent), and the OECD average (2.3 per cent). Not just a boon for the chancellor at his Autumn Statement next week, this also means investors are starting to view the UK as a promising opportunity.

CAUTIOUS OPTIMISM

To some extent, UK markets have lagged their international counterparts this year. Japan’s Nikkei 225 index has risen by 46 per cent in the year to date, the S&P 500 by 23 per cent, while the FTSE 100 has risen by about 11 per cent. Nonetheless, Peter Sleep of Seven Investment Management says the UK market is looking increasingly attractive.

Indeed, Capital Economics recently calculated that the 10-year cyclically-adjusted price-to-earnings ratio of UK non-financial stocks stands at 15, well below both its own long-run average and the current equivalent reading for the US. “But what swings valuations more in favour of companies operating in the UK,” Sleep says, “is that economic growth next year is likely to be fastest here. This could propel earnings higher.” And on a relative basis, the UK looks considerably more attractive than the US, where stocks are “expensive, and the benefit of ultra-cheap financing – which has been a major contributor to earnings growth over the last five years – is largely played out,” says Jason Hollands of BestInvest.

THE BEST APPROACH

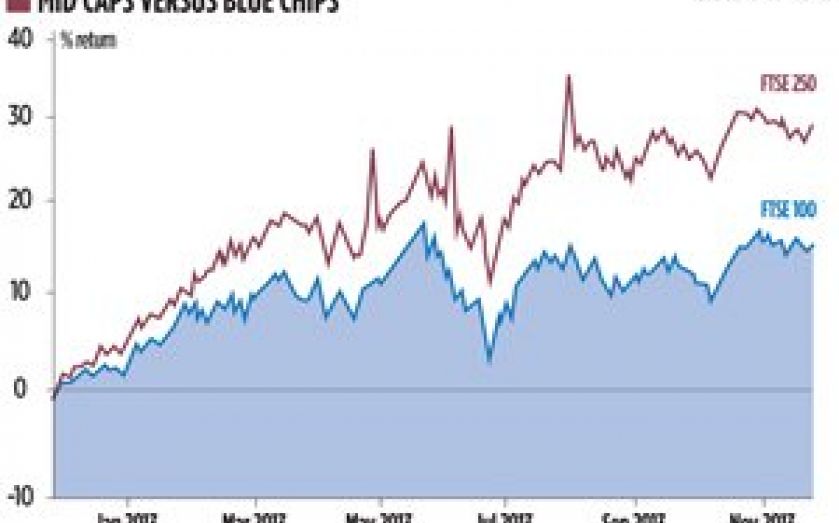

So how best to play the UK recovery? Of course, long-term investors should avoid trying to time the market, and not get distracted by short-term performance. But for those wanting to increase exposure, investment manager BestInvest favours funds with a mid and small cap bias. Why? As UBS’s Caroline Winckles highlighted in City A.M. last month, they often give investors the best chance to benefit from an economic upswing (see graph). They are slightly more expensive, but enable investors to put more into small, faster-growing companies. Mid caps in the FTSE 250 also generate half their sales in the UK, compared to just 25 per cent for firms listed on the FTSE 100, making them better exposed to improving UK consumer sentiment.

And while many have pointed out that the FTSE 100 looks a relative bargain compared to small and mid caps, Hollands worries that the earnings outlook for larger firms is arguably more uncertain. “The FTSE 100 has sizeable weighting to commodities, and is therefore more susceptible to a global growth shock, and our more cautious outlook on China.” Hollands likes the Axa Framlington UK Mid Cap, BlackRock UK Special Situations, and Investec’s UK Alpha fund.

Investors looking at even smaller companies, meanwhile, could find a few gems, says Fidelity’s Tom Stevenson. “Investing in smaller companies means you are more likely to benefit from greater pricing anomalies (as smaller companies are less-well researched), and from more takeover activity.”

To gain a wider exposure, Sleep recommends picking a tracker fund that covers the FTSE All-Share market. “That way, you get more interest in smaller company shares.” He likes the FTSE All-Share Tracker from Royal London Asset Management, which has a relatively low 0.13 per cent annual management charge. But for a “wilder ride,” he points to the Dimensional UK Equity Value fund, which buys cheaper, out-of-favour stocks. “If you can accept the higher volatility, you may earn more over time,” he says.

THE CASE FOR BLUE CHIPS

But it may not be time to write off the FTSE 100. There are now 27 FTSE 100 companies yielding more than 4 per cent, and while the UK economy is open, and UK large companies are highly international, there are a number of businesses which generate all or most of their earnings domestically. Stevenson lists William Hill, Lloyds and National Grid.

And investors with the time and knowledge to stock pick should look to fund management trends for guidance. A number of managers are starting to shift their portfolios from early-stage cyclical companies towards those better positioned for the mid-phase of the recovery. “Mid-recovery periods typically benefit sectors like software and IT hardware, as capital expenditure picks up,” says Hollands.

But Sleep would be cautiously optimistic in buying equities, drip-feeding in cash steadily every month, using an Isa allowance or Self-Invested Personal Pension to build up savings over time. There are longer-term issues to bear in mind. “Global equity markets tend to move together, and we have all done very well from America’s quantitative easing programme until now. I am concerned that a Fed taper could cause a speed bump for investors in the medium term,” he says.