Why City workers are turning their attention to the charms of microbreweries

Craft ale may once have been the preserve of the bearded hipster types who congregate just to the east of the City – but there are signs its charms are creeping westward, as an increasing number of finance sector workers ditch a life of banking for something altogether hoppier.

To be fair, everyone's getting in on the act: figures published in September by the Campaign for Real Ale (Camra) showed the UK now has more breweries per person than anywhere in the world, with 10 per cent growth in the number of small-time brewers for two years running. HM Revenue and Customs, meanwhile, has reported that the number of pints of beer exported from the UK grew by 20.6m pints between 2012 and 2013. That's a lot of booze.

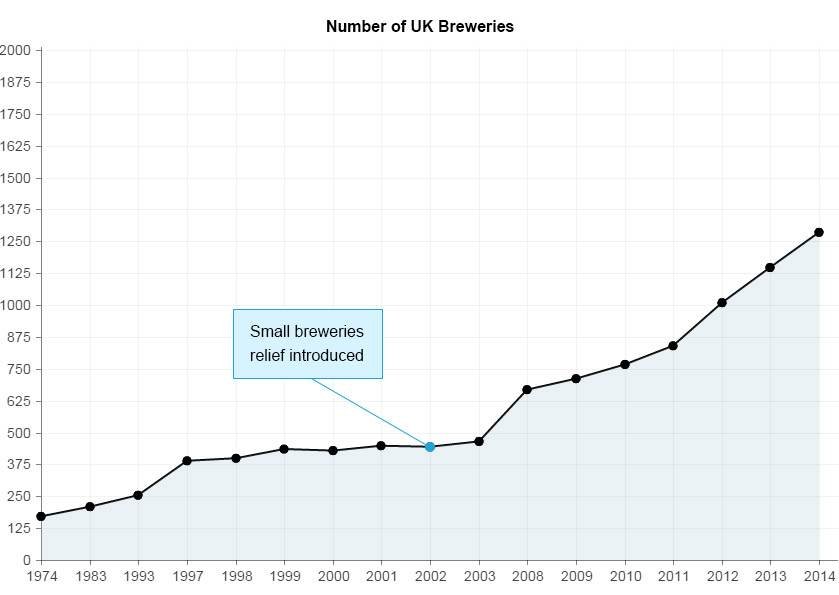

What's to blame for this sudden upswing in craft breweries? It's partly to do with the implementation of the Small Breweries Act in 2002, legislation to ensure smaller brewers pay less tax on the beer they produce.

That means craft brewers remain, for the large part, independent – although big business has recognised their value: this week US animal nutrition giant bought County Down-based craft brewer Newry. And then there's the landmark acquisition by SABMiller, the world's second-largest brewer, of Greenwich brand Meantime in May. "They see the opportunity, and believe in the longevity, of modern craft beer in the UK," said Meantime chief executive Nick Miller at the time.

The beer market is often more rational than financial markets (Source: Jack Terry)

All this suggests it makes sense wannabe craft brewers should know their way around a profit and loss sheet.

“My previous job involved sitting at a desk in front of four screens… under pressure to provide our customers with prices and liquidity that I could not find in the market myself,” explains Andy Moffat, who is now providing customers with "liquidity" of an altogether different kind after he set up Redemption Brewery in north London in 2010.

While the sector may be rather different, Moffat is making use of the skills he learned as a sovereign bond trader for Barclays and Deutsche Bank.

"I learned a lot about understanding and managing risk, which has proven extremely useful in running my own business," he explains.

But it was the attraction of working with something more tangible that drew him to brewing.

“After 15 years my interest waned and I wanted to start my own business with the gratification of dealing with a ‘real product'. I now have great satisfaction when we get people saying nice things about our beers and the work we do. You can’t drink bonds."

Aside from business acumen, Andy thinks microbreweries such as his have done well because there has been a demand for variety and quality locally produced food and drink. “We have been lucky that the pub scene in London has really been transformed over the last five years as more and more pubs focus on locally brewed beers.”

And as relatively small producers they can be nimble and respond to changing demand more quickly.

The Cronx Brewery has seen steady growth distributing their core range to north and east London

Simon Dale, a former regulatory adviser for M&G Investments, is another convert. In 2012, he set up The Cronx Brewery in Croydon with his partner Mark Russell, who had a background in alcohol wholesale.

A fan of Crystal Palace after he visited a beer festival there, Simon saw for himself that the industry was rapidly growing.

"The idea of leaving an office job and starting my own brewery became more and more enamouring,” he says.

With their experience spanning the finance and booze industries, The Cronx recognised that the best strategy would be to grow slowly and organically.

“For us, selling our core range of five beers relatively locally in north and east London where the big beer scenes are, we’ve been gradually improving, gradually growing. It’s slow and incremental but where we want it to be.”

And while starting a business feels like a risk to many, to those leaving the City, it's almost a relaxing experience.

As Moffat explains, “financial markets are not always rational”.

"Real markets", as he calls them, "are usually more rational".

"I feel more comfortable about the risks we face at Redemption,” he says.