Michael Page rebuffs bid from Adecco

A bid significantly above £1bn will be needed to secure recruitment firm Michael Page, analysts said yesterday, as Swiss rival Adecco confirmed an approach.

Adecco’s bid approach, which it said was at an early stage, was believed to be around 350p a share, a level deemed too low by analysts.

“On valuation ,(the) rumoured 350-370 pence (bid) would still undervalue the long-term prospects of the business. Long term-fair value of our forecasts is 445 pence,” said analysts at Royal Bank of Scotland.

Michael Page immediately rebuffed the offer, issuing a statement that “the company has a very strong future as an independent group.”

The group declined to comment further, but analysts said the words reflected the likely feelings of group chief executive Steve Ingham.

In May, Adecco chief executive Dieter Scheiff said the group was on the prowl for acquisitions in the professional staffing business in developed markets such as Europe, Asia and America.

At the time, Scheiff said the group could raise debt of up to €1bn and that it had roughly €400m in shares, which could also be used for an acquisition.

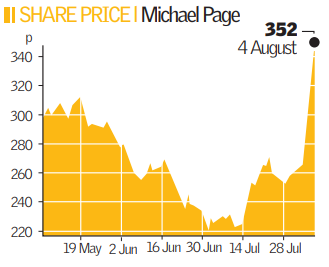

Shares in Michael Page, which before yesterday had more than halved over the past year, shot up 32 per cent to 352p on news of the approach, valuing the recruiter at £1.1bn.

Even after factoring in yesterday’s price rise, Michael Page shares have fallen 36 per cent year-to-date on fears that slowing global economic growth will lead to rising unemployment and, in turn, lower profits.

“A deal of this size at this stage of the cycle is something of a brave move for Adecco given the economic backdrop,” said Panmure Gordon analyst Paul Jones.