MFI under pressure as shares dip

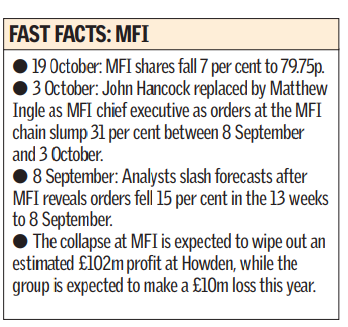

Confidence in MFI’s stricken furniture chain was undermined further yesterday after a damning analyst report sent the shares into a nosedive.

Richard Ratner, of Seymour Pierce, quoted “reliable sources” stating that the British showroom business had sought an extension of credit terms from trade suppliers. He also suggested that the division could be “put into administration early in the new year in order to reshape the business”. MFI vehemently denied that it had approached suppliers. “We have absolutely no plans to put MFI or any part of MFI into administration,” added a company spokesman.

Although the MFI stores business, Britain’s largest furniture retailer, will make a loss this year, it is propped up by its profitable trade arm, Howden Joinery. Its former managing director Matthew Ingle was parachuted in as MFI group chief executive two weeks ago to replace John Hancock, after orders booked with the retailer plunged 31 per cent in September.

Ingle is conducting a lightning review with some downsizing or closures of MFI’s 190 shops expected.

Negotiations continue with the Royal Bank of Scotland regarding the extension of an £180m overdraft.

Furniture retailers are under pressure as consumers avoid big-ticket purchases such as sofas and kitchens. Sunderland-based Durham Pine followed bed retailer Feather and Black into administration earlier this week.