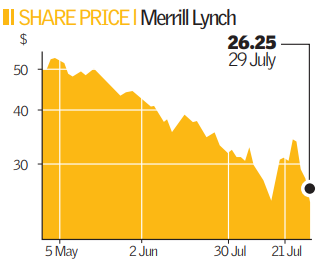

Merrill soars on bet worst could be over

Shares in embattled US banking titan Merrill Lynch jumped nearly 8 per cent yesterday after the bank agreed to sell a massive debt portfolio at a discount, raising investor hopes it was putting its problems behind it.

CEO John Thain has gone back to shareholders to boost the bank’s capital reserves, despite repeated assurances to the contrary.

And just two weeks after revealing a fourth consecutive quarterly loss of $4.6bn (£2.32bn), the bank unveiled a series of measures designed to reduce risk exposure and raise capital.

But investors shrugged off the fact the bank sold $8.55bn of shares to help replenish capital after agreeing to sell the $30.6bn portfolio at a loss and focused instead on the fact Merrill was shedding bad assets.

Leading global banks now face pressure to follow suit and write down or sell billions of dollars in toxic assets.

“The market today is kind of giving the deal the thumbs up,” said Mike Holland, chairman of Holland & Company, on the rise in the share price.

Collateralised debt obligations, toxic mortgage securities, have triggered billions of dollars of write-downs for Merrill, as well as for other banks, and some read Merrill’s decision to sell the assets as a possible turning point for the financial sector.

Rating service Standard & Poor’s said its ratings on Merrill Lynch would not be affected by the sale of the CDO’s.

The US bank has been one of the worst hit by the credit crisis, losing $19.2bn in the last year.

Analyst Views: Should Merill Lynch Shareholders feel hard done by?

Darren Sinden (Lite Financial): ” It’s very disappointing because CEO John Thain said they wouldn’t come back to shareholders for additional funds. What confidence there was in what banks are telling us has been annihilated. If there is any more backtracking from banks about the raising of capital it could seriously upset the apple-cart.”

Gary Thompson (CMC Markets): “There doesn’t seem to be a better way of raising capital at the moment, but John Thain is on very shaky ground now. There are a lot of investors starting to say that he doesn’t know what he is doing. He has clearly had to go back on his word and there is no way he would make the same promises again.”

David Trone (Fox-Pitt, Kelton): “I think it was inevitable that they would have to find a way to raise capital again. They’ve decided to rip the band-aid off and face a bit more pain than they wanted to. Merrill was facing a lot of net exposure but by selling off the CDOs they can probably now start announcing profitable quarters again.”