Meh: FTSE 100 edges up as investors await a glitter bomb from Mario Draghi – but Burberry share price leads the fallers

The FTSE 100 had an uncharacteristically relaxed day of trading today, edging up 0.41 per cent to finish at 6,174.8 points.

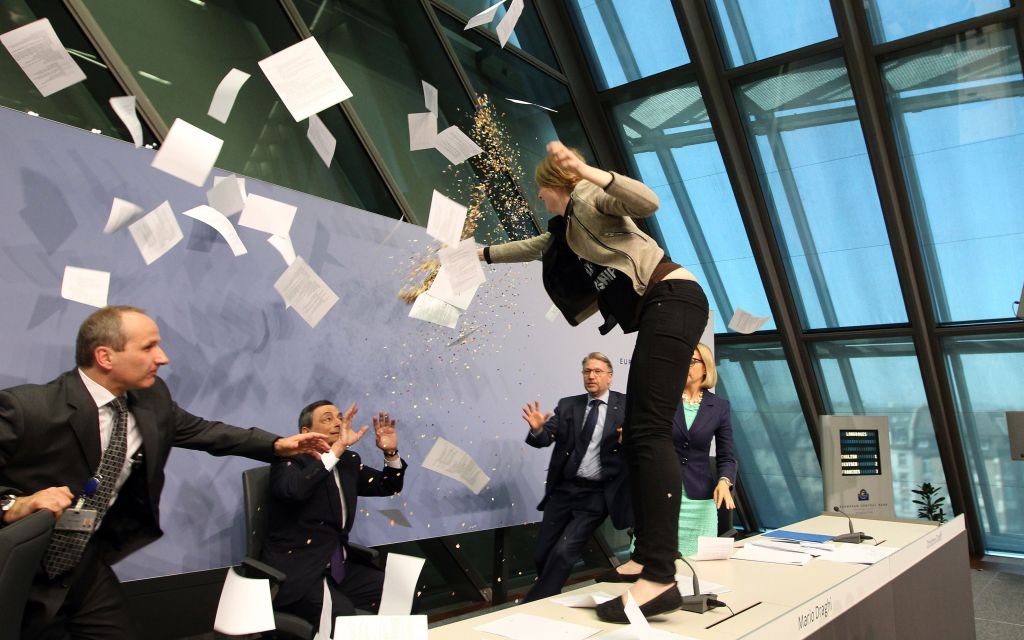

The lacklustre performance came as investors held their breath in anticipation of a potential bombshell from the European Central Bank (ECB) chief tomorrow: it is hoped Mario Draghi will cut the bank's deposit rate by at least 0.1 of a percentage point, to minus 0.4 per cent. In other words: traders' fingers were crossed for Draghi to be the one delivering the glitter bomb this time….

Lest we forget… (Source: Getty)

Markets could barely muster the energy to follow oil, which bounced three per cent, to stick above $40.

"As John Cleese observed in ‘Clockwise’, it’s not the despair that gets you, it’s the hope," pointed out Chris Beauchamp, senior market analyst at IG.

"Traders have learned the wisdom of that observation over the past three days, as stock markets continue to oscillate in relatively tight ranges… No one wants to get caught out with aggressive positioning ahead of a potentially decisive meeting tomorrow."

Still: stocks were pushed higher by Prudential, which jumped 3.1 per cent to 1,367.5p on encouraging results, and followed by Glencore, which rose 2.7 per cent to 143.5p.

Given the weather, it should have been a good day for purveyors of raincoats – but alas, at the other end of the market was Burberry, which lost most of yesterday's gains to end 6.7 per cent lower, at 1,364p, after HSBC admitted the five per cent position it has built up in recent weeks was for a number of players, rather than one investor bent on taking over.

[stockChart code="UKX" date="2016-03-09 16:58"]