Materiality

ESG: What’s material about materiality?

Materiality: the quality of being relevant or significant. It’s not an acronym which, for ESG, is a good start. And the meaning in business and accounting does remain true to its definition. Great! So, what’s the catch? There are differing views about how materiality should be applied when it comes to an ESG or sustainability strategy, and many different inputs to consider when undertaking an assessment. However, as explained below, undertaking a materiality assessment is a critical success factor for any organisation’s ESG strategy.

Why is an ESG materiality assessment important?

Before we jump into the detail, a reminder of some key ESG facts:

- The principle of ESG is about managing the impact of certain intangible assets on a company’s bottom line.

- The scope of what these intangible assets are, across E, S, and G, is not universally defined, and is evolving. Its application is unique to each firm.

- E, S, and G factors can be distinct (e.g., a company’s tax strategy), support one other (e.g., community impact of climate change), and also contradict one another (e.g., human rights issues associated with green energy solutions).

- Sustainability considers a wider focus, with the ethos to do no harm to future generations. This includes the impact a company has on the planet and its people, as well as the reverse, covered by ESG.

Considering the vast and growing number of elements that can be considered in scope of E, S, and G, a company must prioritise those which are of most important, or material. Without this view, companies risk running in multiple different directions and achieving little. Or, focusing efforts on elements that stakeholders (e.g., employees, investors, clients) consider important which, without the internal analysis to back up an alternative option, will result in wasting precious resources and time on activities which have limited benefit.

AIM companies particularly have less time and money to spare and return of investment is paramount. Thus, an upfront investment to understand where a firm can best maximise its ESG opportunities and minimise the risks is a major success factor for any ESG or sustainability strategy.

What are the different views in how materiality should be applied?

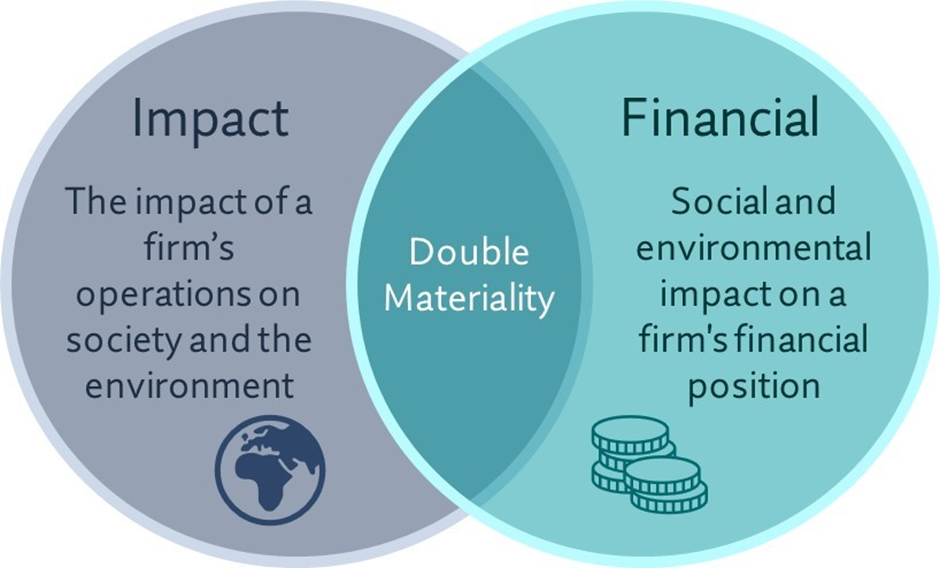

The materiality debate falls into two camps:

- Financial Materiality (or Single Materiality). How the environment and society impact a firm’s financial position, which can be both positive (e.g., a new product, or maximising a competitive advantage) and negative (risk mitigation). Financial Materiality is more aligned to the definition of ESG.

- Double Materiality. Non-financial impact of a firm on the environment and society are considered in addition to financial materiality. For example, the depletion of the world’s natural capital that typically is not priced into products, or the removal of zero-hours contracts which may not be the best thing for a company’s bottom line but is considered materially better for their employees. Double Materiality is more aligned to the definition of Sustainability.

The ISSB reporting standards (released in June) are focused on financial materiality and the EU sustainability standards (released in July) are based on double materiality, as are the long standing GRI standards. The EU standards are already underpinned by regulation and the direction of travel is the ISSB ones will also be in time. Which will ultimately win? The direction of travel is not set in stone, but the optimistic view would tend towards double materiality.

What should firms be doing?

1. Commit to undertaking an ESG materiality assessment now, if one has not yet been completed, and review this periodically as the company, macro trends, best practice, and science evolves.

2. Decide which approach to materiality the firm wants to undertake – financial or double. This will include consideration to the desired outcome of the strategy, scope of stakeholders, and the regulatory horizon with a focus on mandated reporting.

3. Assess the myriad of initiatives that fall under E, S, and G, and establish where the material risks and material opportunities lie. This will be influenced by a company’s products and services, the operating model and operating locations, an understanding of the source-to-end-of-life value chain, stakeholder needs and evolving priorities – investors, clients, employees and suppliers, competitor ESG performance, as well as current and future ESG related regulations.