The big short: Market volatility increases short selling on the FTSE 100 by 15 per cent in 2016 as the number of non-disclosed short positions increases

The turbulent start to the markets has encouraged short sellers to increase their positions – the number of shares on loan has increased 15 per cent since the start of the year, and is now worth $25bn (£17.6bn) according to the latest data from Markit.

Short selling is when an investor borrows shares in order to sell and will buy them back at market price later, thereby making a profit when the price falls. It is effectively betting a company’s share price will fall.

On average across the FTSE 100 constituents, 1.75 per cent of shares are on loan- the highest level in 18 months.

Short interest is the number of shares borrowed to sell short as a percentage of total shares held, or shares outstanding.

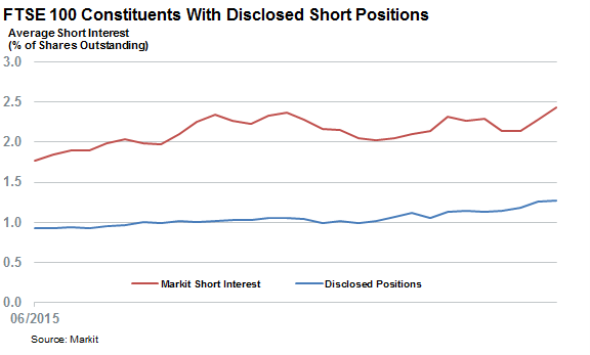

However, Markit analysts suggest that this is just the tip of the iceberg and mandatory public disclosures only reveal a third of UK short positions.

Since 2012 short sellers in Europe must disclose their short positions on a daily basis, but only above a threshold of 0.5 per cent of shares outstanding, which means many short positions are not revealed to the regulator, or the public.

For example, Markit points to Shell, which has five per cent of its shares shorted, worth $3.7bn, but no publicly disclosed positions, as they will all be under the 0.5 per cent threshold.

The average short interest publicly disclosed for the FTSE 100 is 1.3 per cent, but Markit's data suggests total short interest is much higher: with 2.4 per cent of shares out on loan.

Sainsbury's remains the most shorted stock in the FTSE, with 9.5 per cent of its shares on loan, according to publicly disclosed figures.