Market shock: how did investors react to the impact of Covid-19?

Coronavirus brought a decade-long US bull market to an end and sparked a sudden stock market collapse. A surprising proportion of investors responded by taking on more risk.

Faced by of one of the biggest economic shocks in history it is little surprise that the vast majority of investors reacted by changing their portfolios. What is surprising however is that more than a third of investors (35%) took the opportunity to raise their exposure to higher-risk investments.

The latest issue of Schroders’ Global Investor Study, a landmark annual survey of more than 23,000 investors from around the world, suggests a significant proportion of savers viewed February’s fall in share prices as an opportunity to invest further.

The survey, conducted across 32 worldwide locations between 30 April and 15 June 2020, probed savers about their actions following a period of extreme market volatility. This arose as most of the world’s major economies went into lockdown in an effort to limit the Covid-19 pandemic. Between mid-February and mid-March, world stock markets lost approximately one third of their value*.

Almost 80% of respondents said they made some changes to their portfolio as a result. Only 19% said they kept their investments “where they were”. A small 3% were unaware of the turmoil in markets, and so took no action.

Of the 78% who did change their holdings as the crisis unfolded, there was a stark divergence in response. A total 53% said they moved “some” or “a significant proportion” of their portfolio to lower-risk investments. But 35% took contrary action, saying they moved “some” or “a significant proportion” in to high-risk holdings.

“Instinct tells us to take cover after a big shock,” says Rupert Rucker, Schroders’ Head of Income, “and so it is not surprising to see that some investors were selling in the wake of Covid-19. But it’s noteworthy such a large group took the opposite action, and added to their risk.”

He sees this as a sign that investors are becoming increasingly “value aware”.

“We’ve got to remember that Covid-19 came after a long period of rising stock markets, and my sense is that many investors were conscious of valuations becoming high,” he says. “So they saw the February-March correction as a window of opportunity. I think we’re seeing a large cohort of investors not only committed to stock markets, but also increasingly watchful, looking to spot moments of value.”

Discover more:

– Learn: Results of Schroders Global Investor Study 2020

– Read: Investors expect even higher returns from the stock market in years to come

– Watch: Are small and mid-cap companies weathering the US economic storm?

In the short term, the action taken by some bullish respondents is likely to have paid off, as stock markets have rallied strongly since their lows despite a continuing stream of unsettling economic data. “It may also be the case that investors are becoming used to seeing a divergence between stock market performance and economic performance,” Rupert adds.

Are older investors more inured to shocks than younger counterparts?

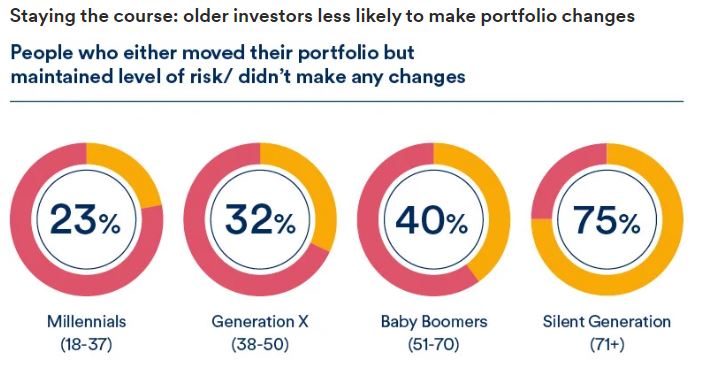

Age or experience – or both – appear to be a clear factor in how investors respond to volatility. Millennial investors (aged 18-37) were almost twice as likely to alter their portfolios as their parents, the “Baby Boomers” (aged 51-70), the research showed.

The oldest cohort of investors, those aged 71 and above, were least likely to change tack.

“There could be a number of factors at play here,” Rupert says. “One is that older investors are perhaps more likely to have structured their portfolios around a long-term plan. This makes it easier for them to step back at moments of crisis, and leave their investments intact.”

Savings are a greater concern following Covid-19…

The outlook for their savings and investments has become a bigger concern for investors since the pandemic.

Before the outbreak of coronavirus, 35% of investors thought about their investments at least weekly. Following Covid-19 this proportion has leaped to 49%. In total, 83% of investors now think about their portfolios at least on a monthly basis.

…but investors are broadly optimistic about the pandemic’s negative economic impact

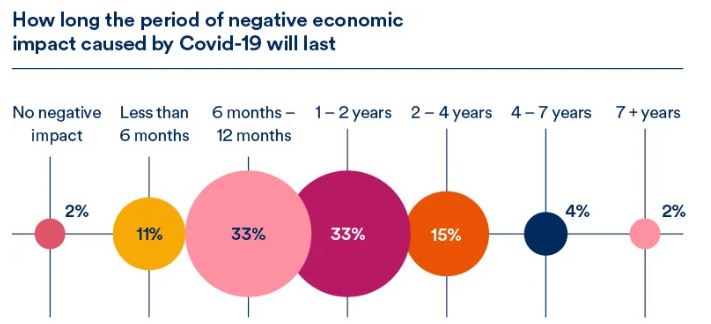

A majority of investors reckon the economic effects of coronavirus will pass within two years, reflecting an optimism that’s not in line with many countries’ own official forecasts.

In the UK, for example, the Office of Budget Responsibility, which now predicts decades-long consequences in terms of national debt, has questioned the extent to which “the resulting economic and fiscal damage [could] turn out to be permanent”.**

Again, investors’ comparatively optimistic response could be due to their experience in the past decade of healthy stock market returns – even while the world economy faced significant challenges.

- View more findings from Schroders’ Global Investor Study 2020

Investment income: savers’ hopes are “unrealistic”

One area where investors took a more negative view was that of the investment income they would expect to receive from their portfolios over the next 12 months.

In 2019, investors expected their holdings to deliver a chunky 10.3% income.

Following the Covid-19 crisis, this has dropped in 2020 to 8.8%.

It is still highly unrealistic, however. Most investments’ “natural yield” – such as the dividends paid to shareholders, or interest paid to bondholders – is far lower than 8.8%. And one of the effects of the Covid-19 crisis has been to push these yields even lower.

Many companies have cut or cancelled dividend payments in the aftermath of the outbreak. Bond yields have also fallen, in part due to central banks such as the Federal Reserve cutting interest rates and committing to keeping them at low levels. This backdrop of ultra-low interest rates is another possible explanation for investors’ readiness to remain invested in stock markets, or increase their exposure to higher-risk holdings.

The role of cash after Covid-19 – who’s holding it, and for what?

While some investors said they were moving a proportion of their portfolio into lower-risk investments, others went further, and said they had switched to cash.

When questioned about their actions following the onset of the pandemic, 18% of respondents said they moved “a significant proportion” of their portfolio into cash.

This raises interesting questions about investors’ future intentions, Rupert Rucker suggests.

“The survey gives an intriguing snapshot into investors’ attitude to cash. Clearly there are investors who view cash as a safe haven in times of crisis, and some respondents said they sold equities and switched into cash,” he says. “But the responses also revealed that a large proportion – more than a third – moved into higher-risk investments, and that suggests to me that some investors hold cash, and other less-volatile assets, as an ‘opportunity pot’ to spend when share prices fall to attractive levels.

“As history shows, in practice it is very difficult to spot the best time to invest. The biggest problem facing those who switched into cash is likely to be the issue of when to go back in to the market.”

*MSCI WORLD fell 34% between 12 February and 23 March. Source: Refinitiv

**UK’s Office for Budget Responsibility, Fiscal Sustainability Report 2020

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.