Market bounces back after last week’s lull – but can it be sustained?

Crypto at a glance

A challenging week for Bitcoin bled into the weekend, with the price falling to just $47,159.49 on Sunday – its lowest level since March 5. Yesterday marked the leading cryptocurrency’s first daily close below $50k since March 6, while market sentiment also fell to its lowest level for almost a year, hitting just 27 on the Fear and Greed index.

However, it seems any talk of a bear market may have been premature. Bitcoin came roaring back overnight, rising for the first time in six days to return almost immediately to just below $53,000, Did this weekend mark the bottom?

Signs are certainly looking good for a V-shaped recovery. Quantum Economics Founder, Mati Greenspan noted on Twitter that “The hashrate that we saw plunge last week has now recovered. Block times are back to normal and the mempool is currently being cleared. Fees will soon be normalized too”.

Real Vision Group founder, Raoul Pal, meanwhile, added more good news, Tweeting that: “The weekly RSI is close to the levels that we saw in corrections in the first part of the 2017 bull run, before Bitcoin hit hyperspace. These are the pauses that refresh a bull market.”

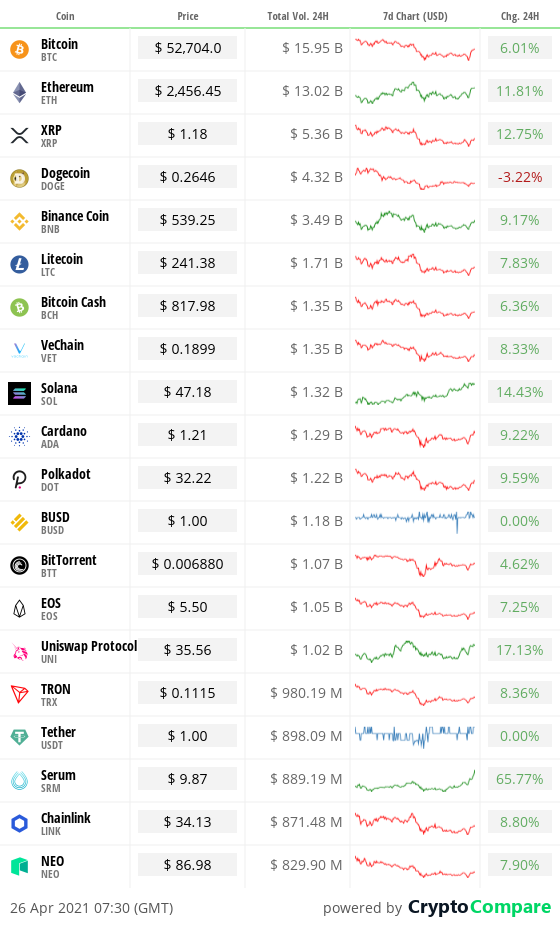

There’s a reassuring splash of green across the board today, with double digit gains for almost all major alts. Ethereum is up 12 per cent and trading just below $2,500 again. Despite last week’s losses, the second-largest cryptocurrency never dipped below that psychologically-important $2,000 level it spent so much of the beginning of the year fighting to break through. Binance Coin (BNB), Cardano (ADA) and XRP (XRP) have also gone some way to erasing the losses made over the past week, all rising more than 10 per cent.

The big climber in the alt markets continues to be Solana though, which has soared to an all-time high of almost $50 and looks set to crack the top 10. It’s now up more than 50 per cent in the last 7 days. Can it continue its run this week?

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

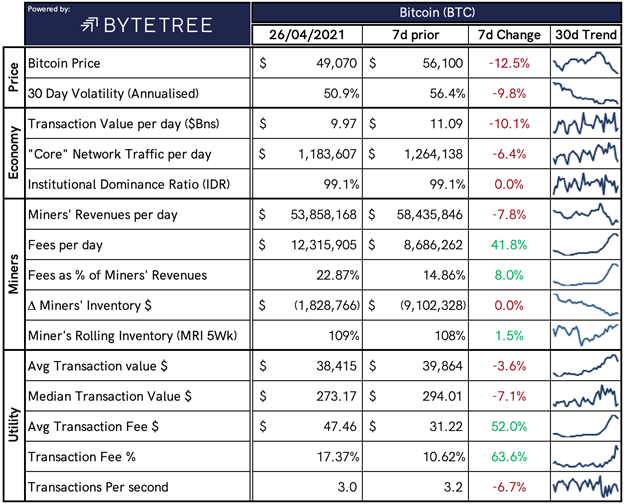

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,957,483,335,553.

What Bitcoin did yesterday

We closed yesterday, April 25 2021, at a price of $49,004.25 – down from $50,050.87 the day before.

The daily high yesterday was $50,506.02and the daily low was $47,159.49.

This time last year, the price of Bitcoin closed the day at $7,569.94. In 2019, it closed at $5,210.52.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $982.71 billion. To put that into context, the market cap of gold is $11.298 trillion and Alphabet (Google) is $1.541 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $58,884,766,713. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 46.01%.

Fear and Greed Index

Market sentiment has plummeted to Fear today and is currently at 27 – that’s the lowest it’s been since April 29 2020, a little under a year ago today.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 51.35. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 41.28. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“There are many many different ways to look at bitcoin. The simplest way is just the supply and demand. Supply is growing 2% a year and demand is growing faster. That’s all you really need to know, and that means it’s going higher … I don’t think this is a bubble at all in bitcoin, I think this is now the beginning of a mainstreaming of it.“

– Founder and chief investment officer of Miller Value Partners, Bill Miller

What they said yesterday

Things are going well then…

Elon knows how to get the market excited…

What bear market?

Touching tribute to a great man…

Crypto AM Editor writes

Bitcoin could pull back to $20,000 claims global investment boss

Bitcoin gets seal of approval as Baillie Gifford ploughs $100m into London crypto firm

API3 and Open Bank Project team up for decade-long blockchain venture

Intelligence dossier finds Bitcoin is outperforming gold but Ethereum is outshining Bitcoin

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021…

Part two of two – April 2021

Five Part Series – March 2021

Day one…

Day two…

Day three…

Day four…

Day five…

Crypto AM: Recommended Events

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021 (announcement soon)

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.