Mark Kleinman: Premier League cash deal for EFL clubs heads for extra time

Mark Kleinman is Sky News’ City Editor and is the man that gets the City talking in his weekly City A.M. column. This week he tackles Premier League deals, Klarna, and the Harrington review.

A decent chunk more ‘Fergie time’ might be needed

It was Sir Alex Ferguson who coined the phrase “squeaky bum time” in homage to that stage of the football season where the stakes become impossibly high. It may only be mid-November, but in terms of footballing politics, that point may already have been reached.

That’s the conundrum confronting 20 Premier League clubs such as Chelsea, Manchester United, and Tottenham Hotspur ahead of the top flight’s latest shareholder meeting next week. Richard Masters, the Premier League chief executive, has been desperate to put a £900m-plus financial redistribution deal with the English Football League to a ballot, telling his clubs this month that he hoped such a scenario would be possible on Tuesday.

He may yet get his wish, but for many clubs, many questions remain about the regulatory model that lies in wait. The establishment of an independent football watchdog has become a fait accompli after the King’s Speech. Even more fundamentally, chairmen throughout the league are querulous about the sums they would have to commit under the new deal to their lower league counterparts, with no clear line of sight yet to their future income.

The latest domestic broadcast rights round (in which my employer’s parent company, Sky, will inevitably play a pivotal role) will not be resolved for several months; although there are expectations that the value of the Premier League’s overseas rights will again increase, the economic environment leaves uncertainty about clubs’ potential income from domestic rights during the period covered by the deal.

And if this sounds like the bleating of England’s richest teams, it’s worth considering that more than a handful of those outside the big six believe the deal as it is currently structured could leave them in genuine financial peril. “There’s no way we can vote for this with so much up in the air,” an executive at one of those 14 told me yesterday.

I understand that during bilateral briefings in the last few weeks, the Premier League has disclosed a request from EFL clubs that they receive half of the first installment of the new deal payments up front. This, I understand, has hardened the resolve of some to turn next week’s meeting into a discussion rather than a formal resolution. Clinching this vote is fast-becoming a test of the Premier League leadership’s credibility. It looks as though a decent chunk more ‘Fergie time’ might be needed to get the new deal over the goal-line.

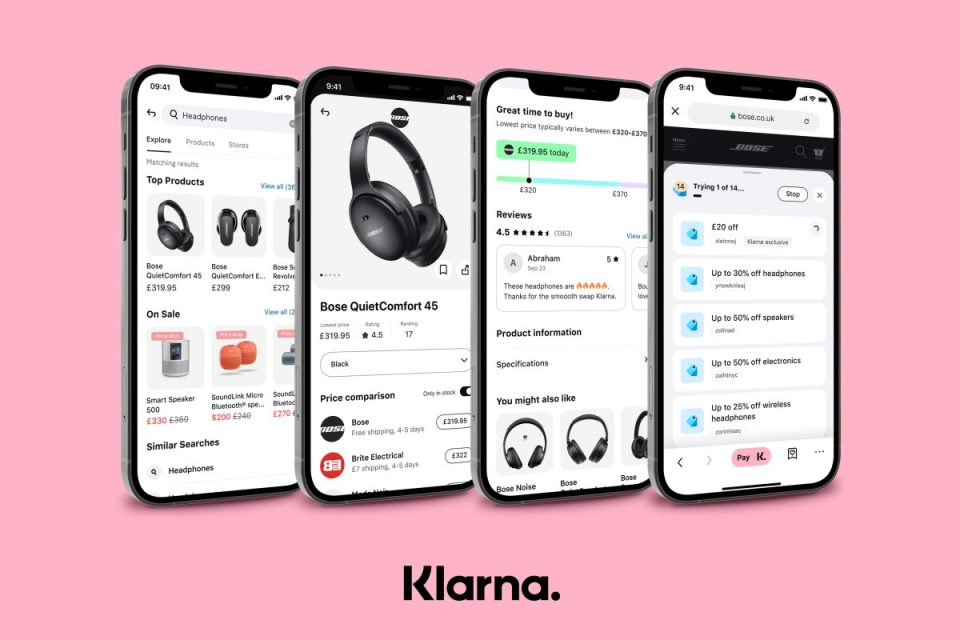

Profit now, float soon for resurgent fintech giant Klarna

Profit now, float soon – that seems to be the new corporate finance mantra adopted by the consumer credit provider, Klarna. Fresh from its first quarterly profit in years, investors believe it will go public as soon as the first half of 2024. That timing would make sense – any later would plunge it headlong into any market volatility approaching the US and UK elections late next year.

Shareholders’ other preoccupation is, of course, the buy now, pay later platform’s valuation: having been forced into a brutal down-round last year which valued the business at $6.7bn, investors are now optimistic that the company can attain a price of more than double that figure based on a comparison with US-listed peer Affirm Holdings. In their view, well in excess of $15bn looks achievable.

Furthermore, I understand that a Whitehall ‘writeround’ cementing government plans to delay any BNPL-specific regulation until the Consumer Credit Act is reformed is all-but complete. There may not be a suitable window at all in 2024 if current market conditions persist, but if there is one, Klarna should jump through it with gusto.

Harrington review must do more than gather dust

‘Race to a trillion’ sounds like the souped-up version of a James Bond television game show. In fact, it was the headline of something even more fanciful: the government’s target for annual exports by the end of the decade. Next week, the Treasury will publish a report by Lord Harrington, the former business minister, examining how to juice the returns from Britain’s efforts to bolster its post-Brexit trading performance.

The Conservative peer’s review, which was commissioned by the chancellor earlier this year, will be focused on foreign direct investment into the UK – a critical growth area for a stuttering economy. Sources tell me that among Lord Harrington’s principal recommendations is that each Whitehall department has a junior minister with a remit to promote investment in Britain.

A new business investment fund that will have the resources to pursue overseas companies that the government wants to see deploying capital in Britain will also feature, according to those who have seen it.

For too long, the lacklustre UK Trade & Investment muddled along, beset by the indecision and bureaucracy to which Whitehall is so accustomed, demonstrating little in the way of a coherent strategy. Even a succession of well-connected senior business figures – Mervyn Davies, Stephen Green, Rona Fairhead, and Mark Price, to name but four – entered the House of Lords in quick succession with a ministerial remit to professionalize Britain’s overseas trade strategy. Most left frustrated at resistance from officials and next to nothing in terms of concrete achievements.

Lord Harrington’s report will almost certainly contain much of value. Yet I wouldn’t bet against it being left to gather dust.

Mark Kleinman can be found tweeting at @markkleinmansky