March inflation comes in higher than expected at 3.2 per cent

Inflation continued its descent in March, but did not fall as far as economists had expected, as the Bank of England considers its next move in interest rates.

According to figures from the Office for National Statistics (ONS), inflation fell to 3.2 per cent last month, down from a previous reading of 3.4 per cent. Economists had expected it to fall to 3.1 per cent.

This meant the headline rate of inflation was at its lowest level in two and a half years.

Core inflation, which strips out volatile components such as food and inflation, fell to 4.2 down from a previous reading of 4.5 per cent.

“Once again, food prices were the main reason for the fall, with prices rising by less than we saw a year ago,” chief economist at the ONS Grant Fitzner said.

“Similarly to last month, we saw a partial offset from rising fuel prices,” he added.

Food prices rose just 0.2 per cent between February and March, taking the annual rate to four per cent. Indeed the ONS noted that prices have been “relatively high but stable” since early last summer.

“UK inflation remained a little higher than hoped in March, reflecting the strength of the economy, particularly the consumer sector, which is in pretty good shape,” Neil Birrell, chief investment offier at Premier Milton Investors said.

The figures come as markets get increasingly nervous about the prospect of interest rate cuts. In the US, traders have significantly dialled back their rate cut expectations following a few hot inflation readings.

This has filtered through to the UK, where traders are now fully pricing in just two rate cuts this year.

However, speaking last night at the International Monetary Fund’s spring meeting, Andrew Bailey, governor of the Bank, said “I see strong evidence now that the (disinflation) process is working its way through.”

“Our judgement with interest rates is how much do we need to see now to be confident of the process,” he said.

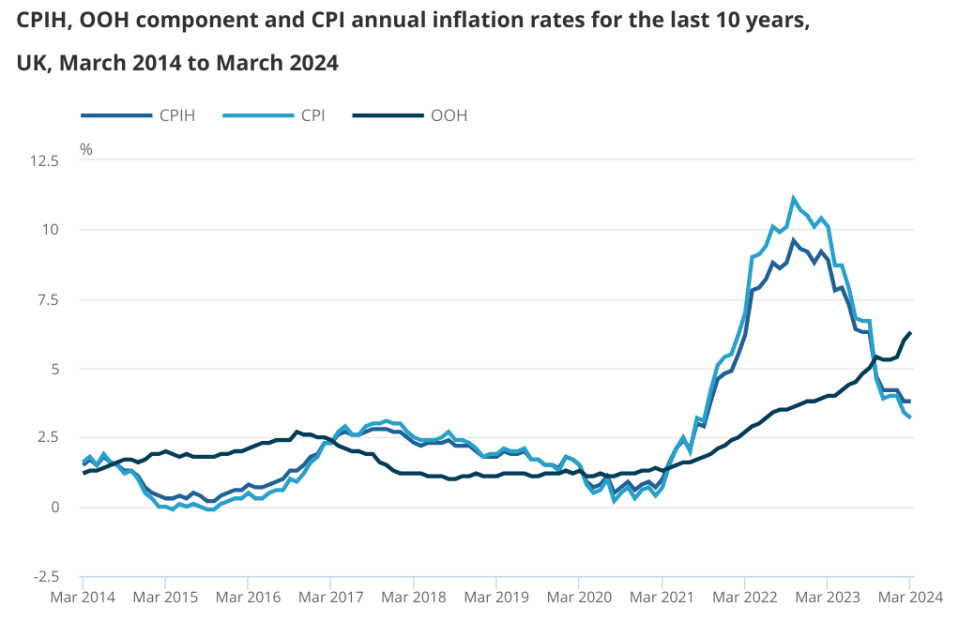

Inflation has fallen from a peak of over 11 per cent in autumn 2022, but the Bank will want to see further progress on services inflation and wage growth – both indicators of domestic inflationary pressures – before cutting rates.

Services inflation fell to 6.0 per cent in March, down from February’s reading of 6.1 per cent but ahead of the 5.8 per cent expected by economists.

Wage growth also remains relatively high. Figures out yesterday showed that annual wage growth barely budged compared to last month, hovering around six per cent.

The Bank of England is still expected to start cutting interest rates in summer, but markets are less certain than they were a few weeks ago. A rate cut is now only fully priced in for November.

Alpesh Paleja, lead economist at the Confederation of British Industry, said this morning’s figures would not derail a summer interest rate cut, but noted “this is by no means a done deal”.