Manufacturing downturn deepens as firms brace for national insurance rise

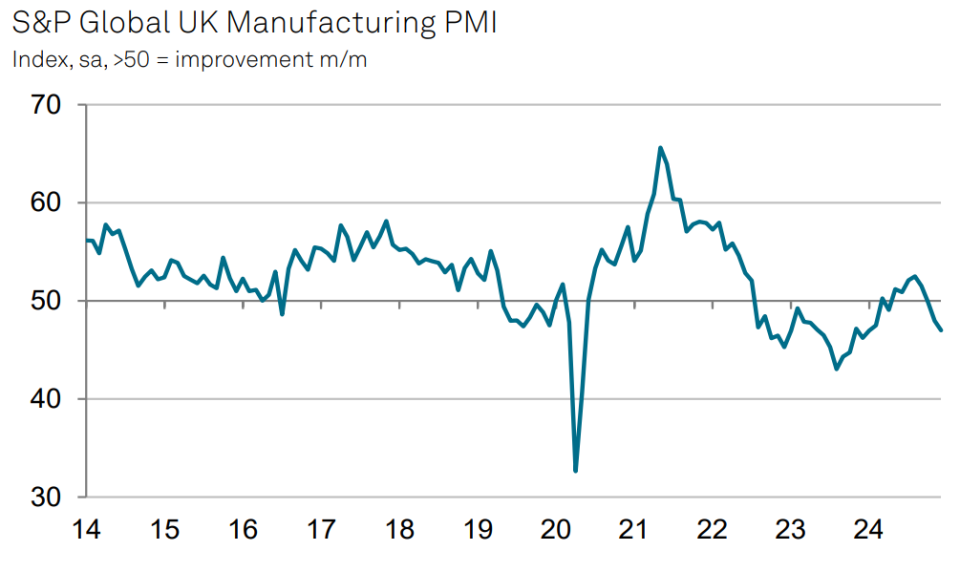

Activity in the UK’s manufacturing sector fell to its lowest level in nearly a year, a new survey shows, as businesses brace for the impact of the government’s first Budget.

According to S&P’s manufacturing purchasing managers’ index (PMI), factory output, new orders and employment, all fell at accelerated rates in December.

This pushed the overall index to 47.0, its lowest level for 11 months and down from 48.0 in November. The reading was also below the earlier ‘flash’ estimate of 47.3.

The survey suggested that the downturn was “widespread” across different sectors and particularly acute among small and medium sized business.

It also showed that business confidence among manufacturers hit a two-year low, partly due to the tax rises on businesses announced in October’s Budget.

Employers’ national insurance hike

Chancellor Rachel Reeves increased employers’ national insurance by 1.2 per cent to 15 per cent while also cutting the threshold at which firms have to start paying the levy.

“Manufacturers are facing an increasingly downbeat backdrop,” Rob Dobson, director at S&P Global Market Intelligence said.

“Business sentiment is now at its lowest for two years, as the new government’s rhetoric and

announced policy changes dampen confidence and raise costs at UK factories and their clients alike. SMEs are being especially hard hit during the latest downturn,” he said.

Lower production reflected a range of factors, including a subdued domestic market, customers de-stocking and weaker demand from European clients.

New business volumes fell to their lowest level since October 2023, with some firms reporting that clients had scaled back on purchasing as they prepared for the impact of the tax hike.

The rate of job cutting also hit a ten-month high in December with firms blaming the forthcoming tax rise and the minimum wage increase.

The survey will add to fears that the government’s first Budget has hit economic momentum. Growth has ground to a standstill since the summer while consumer and corporate confidence has also fallen sharply.

However, Matt Swannell, chief economic adviser to the EY Item Club, suggested the survey could be too pessimistic.

“The PMI results can be heavily affected by swings in business sentiment and the initial negative reaction of businesses to the Autumn Budget could mean that recent survey outturns may be overstating the loss of momentum in the sector,” he said.