Mandatory TCFD Reporting – Deadline Approaching

TCFD reporting is a mandatory reporting requirement – UK investment management firms with over £5bn AUM must publish their first product-level TCFD report by 30 June 2024, while those with over £50bn AUM are already expected to produce quarterly reports.

What must this report include?

Scope 1, 2 & 3 greenhouse gas emissions;

Carbon footprint analysis & weighted average carbon intensity

Climate Value-at-Risk scenario models

Integrum ESG’s platform can sort this out for you – comprehensively and affordably.

TCFD Reporting for Investors – the Integrum ESG solution

Integrum ESG’s newly completed TCFD Report Template consolidates a fund’s TCFD relevant data and scenario analysis, in a clear and comprehensive format.

The platform will provide you with everything you need to satisfy your TCFD reporting requirements – a full report with transparent and accessible data at a low cost to your firm.

All you have to do is upload your portfolio onto the Integrum ESG platform and you can generate a TCFD report for any of your funds, including scenario analysis, within 48 hours of the request being made.

A fund manager client recently used this report Integrum ESG produced to report back to Schroders’ TCFD requirements – who were very satisfied with the results.

What does Integrum ESG’s TCFD template include?

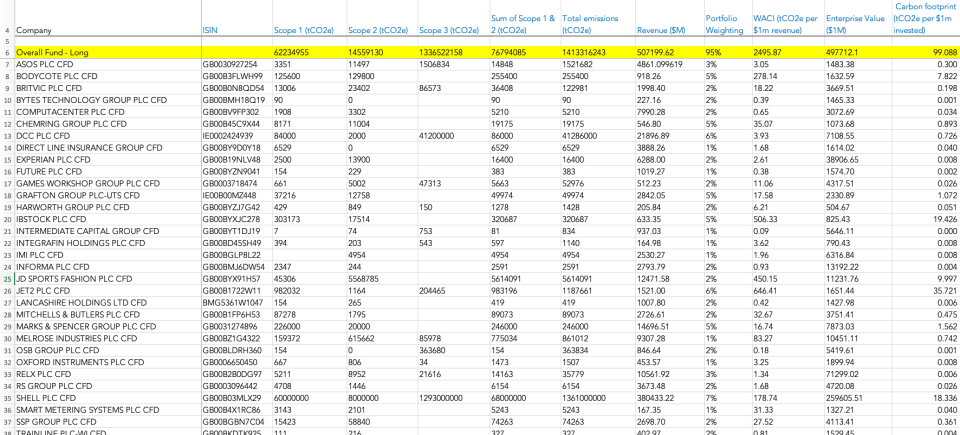

Carbon Footprint Analysis

Integrum ESG capture and display Scope 1, 2 & 3 emissions for all of your holdings.

See your overall portfolio footprint or drill-down to see the exact contributions each of your holdings are making to the overall footprint.

Implied Temperature Rise

Integrum ESG calculate a temperature score for every portfolio you upload to their platform.

They deploy the Cambridge University Implied Temperature Rise Model to show you the level of global warming – in degrees centigrade – that would be created if that portfolio represented the global economy.

Climate Value-at-Risk

Integrum ESG assess the impact to each of your holdings’ profitability from a carbon price, and use that % impact to profitability as a proxy for the Value-at-Risk.

Utilising all of the data above, all of the necessary calculations will be made for you and you will have a TCFD scenario analysis report produced within 48 hours – a report which will satisfy the FCA and any investor.

A platform made for investors, by investors

The Integrum ESG platform can provide you with everything you need to satisfy your TCFD reporting requirements – transparent and accessible data at a low cost to your firm.

Please email contact@integrumesg.com or use the link below to learn more about how Integrum ESG can provide you with comprehensive ESG data and a number of best-in-class ESG reporting solutions – all within your quarterly budget.