M&A Roundup: HY 2022

This year has been challenging on many levels – inflation is impacting economic demand, the cost of living crises carries on, and the war in Ukraine continues. However, in terms of M&A, EMEA is withstanding the headwinds rather well.

Per Mergermarket figures, deal count totalled 4,963 compared with 6,182 in H1 2021, a fall of 19.7%. This downward trend was most pronounced in the second quarter, following the invasion of Ukraine and as risk-off sentiment gripped markets.

However, value has been fairly steady and rose quarter-on-quarter in Q2. Over the first six months, there were €579bn worth of transactions, down by only 6.5% on last year. Moreover, the €334bn minted in Q2 was above both Q1 and Q2 2021, thanks to a handful of megadeals.

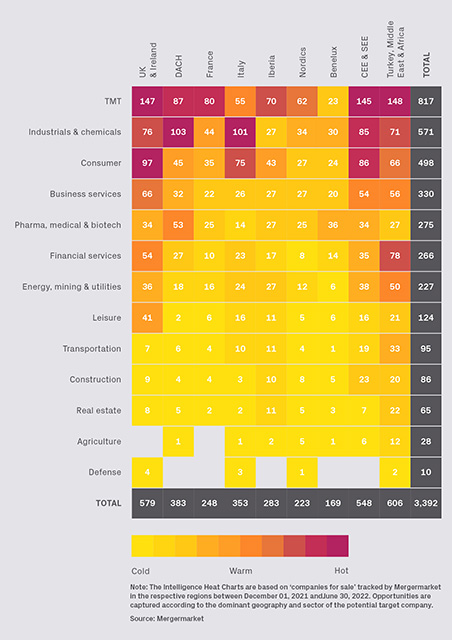

Unsurprisingly, TMT continued to lead the way, both in volume and value terms. Unlike North America and APAC, TMT deal flow in EMEA stems from the ongoing restructuring of Europe’s telecoms industry, which has been under years of heavy revenue pressure due to strong competition. Many telcos have been selling their infrastructure as separate telecom tower units backed by infrastructure investors, raising cash from the sales and reducing their capex overheads on an ongoing basis, while refining their corporate strategies.

Telcos are seeing their revenues stabilize, driven by new broadband products that are typically bundled with mobile and streaming services in a single product. Many of these companies have spent recent years becoming operationally leaner organizations that have moved away from legacy systems.

Second to the TMT sector was I&C, almost exactly matching last year’s figure. The largest of these deals made it to third place in the top-10 table and is illustrative of how macro themes are shaping the deal landscape and will continue to do so.

These megadeals are also proof that, despite the current ongoing challenges, EMEA is still very much open for business. Moreover, the TMT and I&C sectors are expected to deliver the highest M&A volume over the remainder of 2022, continuing the H1 trend. While a recession is looming in Europe, this could create opportunities and rationale for corporate dealmaking and may even encourage financial sponsors to deploy more heavily as they capitalize on more attractive valuations.

Read latest Deal Drivers EMEA HY 2022 report to learn which sectors drove dealmaking in H1 2022, including the latest heat chart, league tables, and top bidders by value and volume.