Luxury brands Watches of Switzerland and Burberry suffer on Trump tariffs

The share prices of high-end retailers Watches of Switzerland and Burberry both slid today in the wake of Trump’s tariff announcement.

Watches of Switzerland saw its share price drop more than 15 per cent, while Burberry’s share price fell by nearly seven per cent.

“There are heavy losses for the luxury sector,” Kathleen Brooks, research director at XTB, said. “Investors are still seeking out areas of safety, including utilities, real estate, healthcare and consumer staples.”

North America accounts for just under a quarter of British luxury exports and the lion’s share of this trade is with the United States, according to industry body Walpole.

RBC analysts have estimated an “elevated tariff impact” for Burberry due its sourcing mix, which is the combination of countries and suppliers used to produce the luxury brand’s goods.

Burberry works with a network of global suppliers, with an specific outerwear factory in Italy and a scarf production centre in Scotland. Goods produced in Italy face a tariff of 20 per cent in the US.

America accounts for around 20 per cent of Burberry’s revenue, and was the only area to show sales growth year on year in the company’s latest quarterly results – making it a key part of the brand’s turnaround plan.

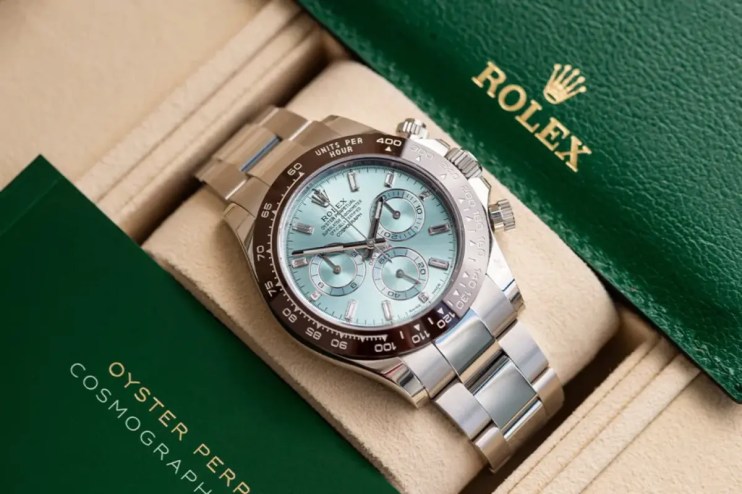

Watches of Switzerland, meanwhile, has seen such a dramatic drop in its share price in part because an additional 31 per cent tariff will be charged on all imports from Switzerland into the United States.

Switzerland was singled out by Trump as one of the worst culprits of unfair trade with America. Last year, the US had a CHF 38.5bn (£33.9bn) trade deficit with the European nation.

RBC analysts also pointed out that the watch firm has lower margins compared to competitors, making it more difficult to respond to tariffs.

“[In response] companies can either raise prices, change country of origin (to the extent possible), renegotiate supplier terms… or absorb tariff costs.

“We believe luxury companies are likely to pass on some pricing as potential offset which will result in higher US prices,” RBC analysts said.