Looking ahead to the FED this evening

Wednesday the 2nd of November today and we are a few hours away from the next monetary policy update from the Federal Reserve. Looking ahead to today’s meeting the FED is widely expected to hike their target Fed Funds range by another 75 basis points to bring it to a range of 3.75%-4%. This would mark the 6th consecutive rate hike and a 4th consecutive hike 75 bps, showing the scale of the task needed to get inflation under control. The question comes though, what next?

The hike itself is not what we need to look out for, central banks around the world are hiking massive amounts around the world, but it is future updates which we need to look towards for some trading opportunities. We’ll need to keep a firm focus on the forward guidance provided and also then towards Jerome Powell’s press conference as we are expecting some indication of when the slow down in hikes will come as we now begin the approach to the terminal rate of 4.5%-5%

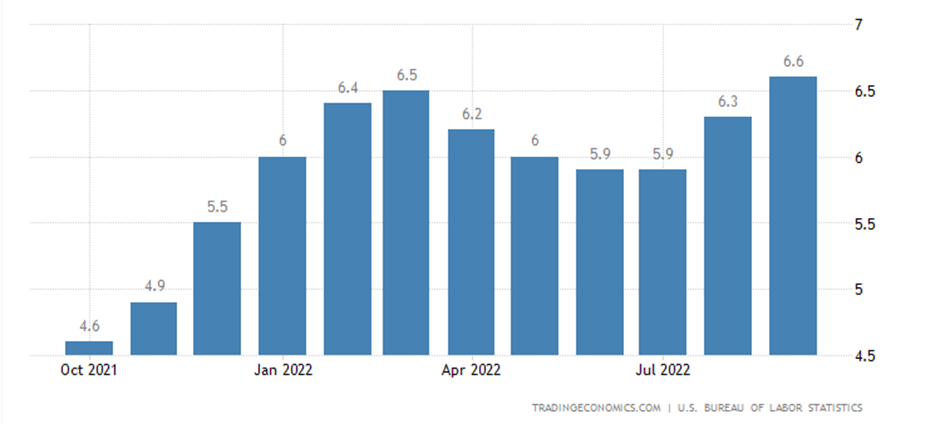

The difficulty the FED face is the lack of progress on cooling inflation.

As we can see above, there was a couple of months of the Core CPI pulling back from March through to July. Since then, it’s made its way higher again back to the highest print since 1982. Difficult situation to be in for Mr Powell.

If they feel as if they need to do more then we could be in for a hawkish surprise. In my opinion that would consist of no update on the pausing of hikes, or a higher revision of the target range which was left at 4.6% according to the dot plot back in September. Both of these you would think would send the Dollar higher and stocks lower.

Dovish risks then I would say involve a signalling of a 50-bps hike in December while deciding not to give us an update on a higher terminal rate, which would show the terminal rate we are expecting remains intact. Expectations would then shift to a pause from the Fed, which should result in a Dollar move lower and stocks enjoying some upside.

Key markets to look at:

The US 10-year yield continues to provide some direction for us in recent trading sessions. The correlation between this is usually positive with the USD and inverse with the S&P500. These 3 are what I’d keep my eyes on personally. The DXY and US10Y should be able to help us navigate USD moves across the board. Couple those with the S&P then and we can look at stock indexes.

The DXY at the time of writing is up at 111.13, a few dollars off the highs posted back on the 28th of September at 114.77. Topside levels are limited but below 109.50 looks a decent place to get short on a dovish surprise. Through the trendline, lower low and the round number would be a significant break although it may be tricky to reach that today. On a hawkish surprise, above yesterdays high at 111.70 leaves us with a bit of space up to 113 although much less significant of a level.

On the 10 year yield we are trapped in a pretty tight range for about a week now. There is not much need for anymore than the top and bottom of that range for levels to keep an eye on. Charts still in an overall uptrend so anything that stays above the low at 3.9% you’d have to imagine is still bullish. A break through that and there’s not much support until 3.56%. The top of this range is sat at 4.11%. I think a break above that and a test of the highs at 4.33% is on. That 4% level was definitely relevant when we first got there, however interest in it has quite clearly waned.

On to the S&P now then and there is not much going on in terms of levels. Yesterdays high is 3916 and that’s probably the line in the sand for a move higher. Not much above that though and if we get a dovish reaction today we should be on for a test of that trendline up at 4000. There’s a better level to the downside at 3763. The chart still looks somewhat positive on current price action and if price remains above 3763, that will probably remain the case.

It’s essential to ensure you have the right skills and knowledge to capitalise on the opportunities presented from a recession and studying a trading course at an accredited, award-winning academy can help provide you with an advantage. The London Academy of Trading’s combination of practical application and theory can provide you with the skills to thrive in financial markets, whilst their 10h/day support can help provide immediate help and advice.