London’s tourist tax: Struggling luxury brands LVMH, Mulberry and Burberry have other problems, too

Mulberry has fallen out of fashion with investors as shares slumped over four per cent this morning, with the luxury retailers expressing growing concerns about flattening sales and the tourist tax.

The British fashion house, best known for its leather handbags, has had around £3bn wiped off its market value in the last five months amid what has been dubbed a “rich-session”.

UK retail sales took a four per cent hit, while group revenue over the golden quarter fell 8.4 per cent, as customers opted not to treat their loved ones to a £650 satchel.

Alongside, warning on economic pressures, boss Thierry Andretta, blamed the UK’s tourist tax for damaging sales of its expensive garments, echoing calls from fellow designer Burberry back in November.

PM Rishi Sunak scrapped VAT free shopping for international tourists back in 2021, when he was chancellor, hindering how much wealthy foreign customers want to pay when they holiday in Britain.

It has been a major sore spot for not only retailers but also hotel and restaurant group’s and has been expected to cost the UK economy £4.1bn.

But big wigs at luxury firms know – and have stated there are wider issues at play here.

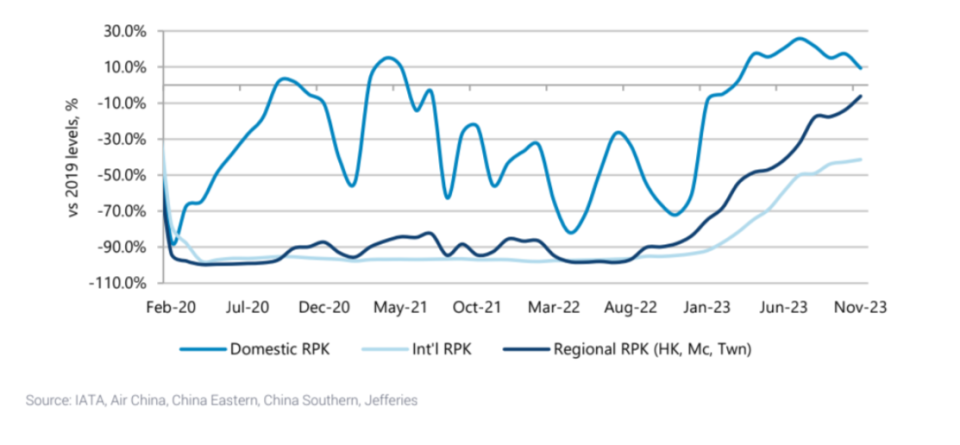

There is a lagging revival in China following pandemic restrictions and ever-changing consumer habits.

Sophie Lund-Yates, lead equity analyst, Hargreaves Lansdown, explained:“While changes to the tax landscape are certainly unhelpful, they don’t account for all the weakness being seen in the luxury market.

“In particular, the rebound from China has been weaker than promised, and there simply isn’t enough domestic demand to pick up all of the slack.”

She added: “We’ve seen weakness in the US from recent Burberry numbers and that’s indicative of a broader pull back in spending, which is a trend that could be ongoing for a while.”

Shares in the trench coat and tartan scarf maker slumped to a four year low last week after it issued its second profit warning in three months because of slowing sales in America and the EMEA.

Market jitters surrounding designer retailers are expected to continue.

Analysts at Jefferies agreed on Friday to cut their 2024 industry demand growth assumption for global luxury brands from four per cent to two per cent.

“Our circumspect view on luxury still stands early in 2024,” they said.

“The upcoming reporting season should highlight the risk of another year of US normalisation, ongoing weakness in Europe and the possibility of a limited boost from travel to Chinese spend.”

It is not the confidence boost French multinational LVMH will be hoping for ahead of its full year report next week.

The Dior and Louis Vuitton owner has been riding a strong wave of spending in America, helped by its beauty store Sephora and post-pandemic splurging.

Figures from the National Retail Federation, showed that US customers were willing to spend despite interest rate rises from the Fed.

But Jack Kleinhenz, chief economist at the federation warned this trend may not last much longer.

He said: “The labour market looks set to cool further this year, which will impact consumer expectations for employment and wage growth, and, in turn, affect spending decisions.

“While the amount of credit appears in the aggregate to be manageable as incomes have risen, consumers have ratcheted revolving debt back up to pre-pandemic levels.”