Number of listed firms on London’s stock market shrunk faster than European rivals

The tally of companies choosing to list on the London Stock Exchange contracted sharply over the last decade as companies increasingly choose to raise money through private equity deals, a trend also seen in the wider European market.

The London Stock Exchange lost 378 companies on net between 2010 and 2018, a 21 per cent drop that took its total size to 1,439 firms, new analysis by economics consultancy Oxera has shown.

It was the biggest numerical fall of any European market over the period.

However, the 21 per cent drop was behind Frankfurt and equal with Brussels.

As a whole, the stock markets of the 28 countries that made up the EU during the period lost 12 per cent of their companies. That amounted to a net drop of 854 firms.

The churn in European stock markets means that London’s position as the biggest exchange in Europe is under threat.

Euronext’s group of exchanges, which spans France, Amsterdam, Brussels, Dublin and Lisbon, appears set to overtake the LSE in number of firms. Should it manage to buy Borsa Italiana, it would be roughly comparable in size.

Why do companies leave the London market?

London bares brunt of shrinkage

“London has borne the brunt of the public equity market shrinkage in Europe,” said Reinder Van Dijk, partner at Oxera.

In part, the fall came down to the higher cost of raising public equity capital compared to PE, Oxera said.

Regulations are tougher for listed business, which has also put companies off, Oxera said.

“‘Small and mid cap companies in particular now find it particularly difficult to justify a listing, given the fees, regulatory burden and comparatively high costs relative to private markets,” said Van Dijk.

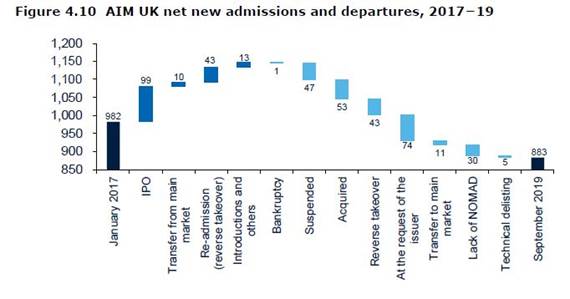

Analysis of the smaller AIM market showed that requesting to delist was the most common reason for leaving in 2018. It was behind 28 per cent of exits.

Van Dijk also said that the LSE was likely to lose its place as the biggest exchange to Euronext. “These trends in growth are now very well-established and it is difficult to see them changing in the short term.”