London’s FTSE 100 drops after second big Bank of England rate hike

London’s FTSE 100 plunged today after the Bank of England lifted interest rates 50 basis points for the second time in a row.

The capital’s premier index fell 1.08 per cent to 7,159.52 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, tumbled 2.05 per cent to 18,331.69 points.

Traders were seemingly wobbling before Bank governor Andrew Bailey and the rest of the monetary policy committee over fears they would lift borrowing costs by as much as 75 basis points.

Central banks reining in stimulative policy has loomed over global markets this year, driving stocks lower and bonds higher. Bond prices and yields move inversely.

Yesterday, the US Federal Reserve hiked rates 75 basis points for the third time in a row, to between three and 3.25 per cent.

Since March, the Fed has signed off 300 basis points of hikes, the quickest tightening cycle since the 1980s.

This morning, the Swiss central bank also lifted rates 75 basis points, taking them out of negative territory.

Higher borrowing costs tend to weigh on stocks by making bonds more attractive and reducing investors’ valuations.

The pound, which has hovered around a 40-year low against the US dollar this month, weakened against the greenback.

The prospect of a jumbo Bank of England rate hike initially strengthened sterling. Higher rates often boost currencies by reducing inflation and incentivising investors to buy assets denominated in said currency.

Yields on UK government debt bumped higher today.

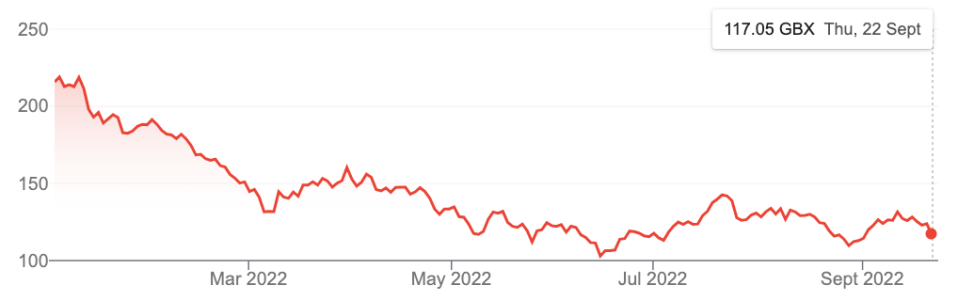

London’s FTSE 100 was dragged down by high street fashion retailer JD Sports shedding over eight per cent after it warned profits will slim amid the economic slowdown.

JD Sports share price this year

Cult bootmaker and FTSE 250-listed Dr Martens weighed on the mid-cap index, losing nearly five per cent.

Oil prices jumped around one per cent.