London’s FTSE 100 hit by slumping energy prices and downturn jitters

London’s FTSE 100 today was ensnared by investors fretting over a slowdown in the world economy and falling energy prices.

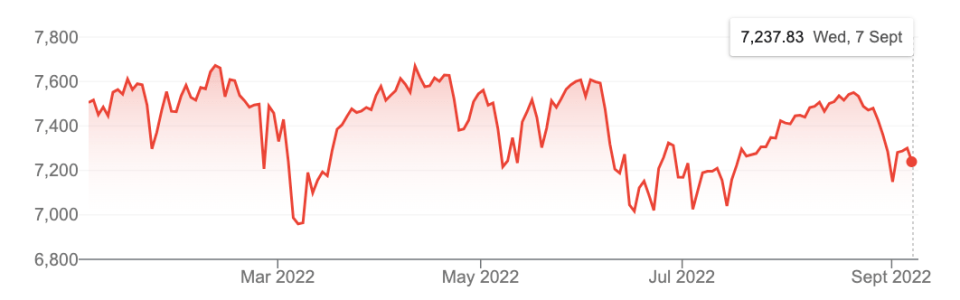

The capital’s premier index dropped 0.86 per cent to 7,237.83 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, edged 0.05 per cent lower to 18,811.48 points.

FTSE 100 year to date

The world’s biggest companies fared poorly in overnight trading on Wall Street and in Asia, dragging down London’s FTSE 100 early exchanges and setting the tone for the rest of the day.

Investors are sweating over a mixture of soaring energy prices hitting households and businesses and central banks raising interest rates sharply to tame elevated inflation.

Prices are up 10.1 per cent in the UK, prompting the City price in a more than 50 per cent chance the Bank of England will hike rates 75 basis points at its next meeting on 15 September.

The European Central Bank is also anticipated to sign off on a huge rate rise at its meeting tomorrow, while the US Federal Reserve is also expected to keep raising borrowing costs at a rapid clip.

Some of the world’s biggest economies are set to tip into recession this year, weighing on energy prices and hitting the FTSE 100 due to its heavy weighting toward industrial firms.

“Fears over a prolonged slowdown has seen oil prices slide to their lowest levels since February,” Michael Hewson, chief market analyst at CMC Markets, said, adding “this has weighed on the basic resources and energy sector over recession concerns, pulling the FTSE 100 sharply lower.”

UK investors were boosted yesterday by new prime minister Liz Truss hinting she will spend around £100bn of taxpayers’ money to freeze energy bills at around £2,500 to cushion the cost of living crunch.

“Given the big package that is expected, anything short could spark renewed selling in consumer-facing stocks,” Russ Mould, investment director at AJ Bell, said.

The pound, which has fallen steeply against the US dollar in recent dollars, slumped to the lowest level against greenback since 1985.