London’s FTSE 100 bumps higher after government halves firms’ energy bills

London’s FTSE 100 bumped higher today as investors digest the details of the government’s energy support package for UK businesses.

The capital’s premier index climbed 0.63 per cent to 7,237.64 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, rose 1.01 per cent to 18,714.67 points.

Today, the government fleshed out its measures to ease the burden of soaring energy on firms.

Under the policy, businesses’ bills will be slashed by more than half, “supporting growth, preventing unnecessary insolvencies and protecting jobs,” the Department for Business, Energy and Industrial Strategy said in a statement.

The move will swell the UK’s debt pile.

Experts have warned the UK was headed for a tough recession unless the government absorbed some of the energy price shock.

The announcement illuminates the scale of support for businesses mentioned by prime minister Liz Truss earlier this month when she said they would receive “equivalent” help to households, who have had their bills frozen at £2,500 for two years.

Chancellor Kwasi Kwarteng at Friday’s mini-budget is expected to offer more help in the form of reversing the national insurance and corporation tax hikes.

The City and investors around the world are also bracing for the US Federal Reserve to announce their latest interest rate decision later today.

Most expect chair Jerome Powell and co to lift rates 75 basis points. There is an outside chance of a whole percentage point rise.

“There are some concerns that the statement from Jay Powell could be very hawkish. Markets will be on the lookout especially for references to the length of time the Fed will maintain restrictive policy,” Neil Wilson, chief market analyst at Markets.com, said.

London’s FTSE 100 was boosted by house builders after reports in The Times today indicate Kwarteng will also cut stamp duty at this Friday’s fiscal event.

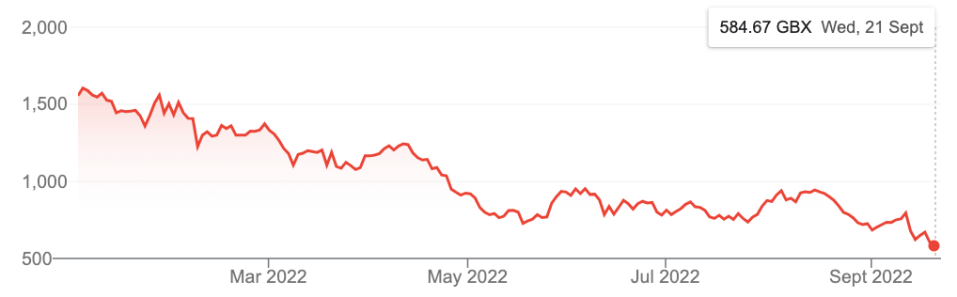

Middle-class favourite and online supermarket Ocado continued its recent descent, losing over five per cent.

Ocado’s shares have tanked more than 60 per cent this year

The pound, which hit a 37-year low against the US dollar last week, slumped 0.6 per cent against the greenback.