London’s FTSE 100 bounces despite GDP undershoot

London’s FTSE 100 bounced today despite new figures revealing the UK economy is much weaker than expected.

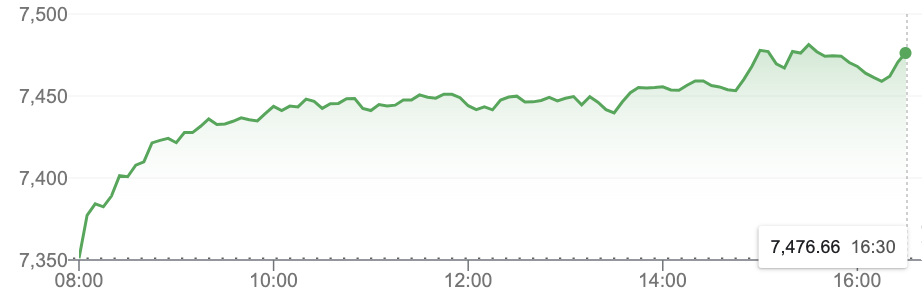

The capital’s premier index climbed 1.66 per cent to 7,473.03 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, surged 1.7 per cent to 19,513.87 points.

Traders shook off a downbeat GDP print from the Office for National Statistics this morning which revealed the economy grew 0.2 per cent in July, weaker than analysts’ forecast.

FTSE 100 posts upbeat day

The glum data prompted experts to warn the economy is in the teeth of a slump.

“The disappointingly small rebound in real GDP in July suggests that the economy has little momentum and is probably already in recession,” Paul Dales, chief UK economist at consultancy Capital Economics, said.

Analysts said a reduction in international energy prices, which has driven a tough inflation surge, lifted investors.

“The weakness in natural gas prices is especially welcome, with UK prices sliding to their lowest levels since 21 July,” Michael Hewson, chief market analyst at CMC Markets UK, said.

The pound, which has been in free fall against the US dollar in recent months, strengthened nearly one per cent against the greenback to $1.1694.

Traders are betting the Bank of England is set to keep hiking interest rates to tame a 40-year high inflation jump of 10.1 per cent.

Higher rates often boost currencies.

Analysts at Deutsche Bank think rates could climb to four per cent.

Expectations of higher borrowing costs boosted high street banks, lifting London’s FTSE 100.

NatWest gained more than three per cent. Higher rates benefit lenders as they allow them to charge more for loans.

On the FTSE 250, high street fashion chain Marks and Spencer was among the biggest risers, climbing nearly eight per cent.

Oil prices rose.

European shares finished nearly two per cent hight.