London’s economy powers through August in ‘growth mode’ as UK stalls

London’s economy powered through August in “growth mode” despite the UK stalling, a new survey published today reveals.

High street bank NatWest’s London purchasing managers’ index (PMI) remained in positive territory in August at 54.9.

However, the PMI dropped sharply from 58 in July and was the weakest reading in nearly a year and a half. August’s reading was still above the 50 point threshold meaning most firms reported growth.

“The capital remained firmly in growth mode in August, despite more UK regions falling into contraction territory,” Catherine Van Weenen, NatWest London and the south east regional board, said.

London businesses reported the strongest expansion of any region in the UK. The nationwide PMI slipped below the 50 point threshold, NatWest said.

Demand in the capital’s economy remains much stronger compared to the UK average.

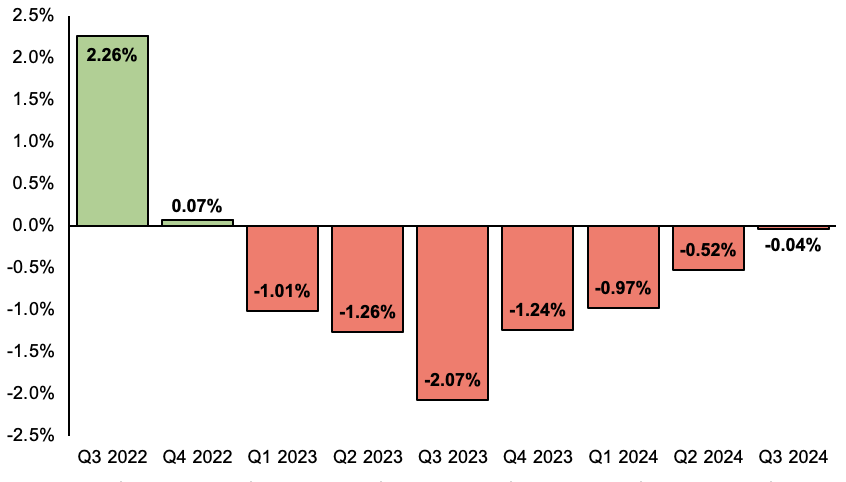

Bank of England’s August GDP forecast

New business growth dropped to an 18-month low, but was still racing ahead at a quick pace. The country as a whole notched a contraction in new business activity.

Britain is projected to tip into a drawn out recession beginning at the end of this year, driven by consumers and businesses responding to scorching inflation by reining in spending.

Liz Truss’s energy support package may mean the UK narrowly avoids a recession.

However, NatWest’s PMI indicates London’s economy may avoid a tough slowdown.

Recruitment activity in the capital was the strongest in the country. Firms across the UK continued to hire staff despite recession fears.

However, staff shortages are hitting London firms harder, the PMI suggests.

“London was the only monitored UK region to register an increase in backlogs during the latest month,” NatWest said, driven by worker shortages hamstringing businesses’ capacity.

The survey indicates swelling energy, commodity and transport costs are starting to cool.“While energy costs and wage growth remained key challenges to firms, the data offers hope that underlying price pressures have cooled off from the highs recorded in the second quarter,” Van Weenen added.