London Stock Exchange steps in and cancels trades in rebounding Polymetal International

The London Stock Exchange (LSE) has cancelled all trades in Polymetal International (Polymetal) between 8.41am and 9.02am.

Trades in the Anglo-Russian precious metals mining company during this time period were found in breach of stock exchange rules 2120 and 3022 – which concern erroneous trades and enforced cancellations.

LSE’s market surveillance team actively monitors trading activity on the exchange to ensure an orderly market.

The Anglo-Russian precious metals miner is listed in the UK, but its operations are chiefly located in Russia, which has been hit with painful economic sanctions following its invasion of Ukraine.

At close of play, the Polymetal was up just 1.86 per cent on Monday – having spiked over 20 per cent earlier in the session amid increased investor confusion.

Polymetal refused to comment on LSE’s decision, but confirmed to City A.M. six of its nine board members have left the company this morning.

In a terse one-sentence statement, Polymetal said chairman Ian Cockerill had quit his role, alongside Ollie Oliveira, Tracey Kerr, Italia Boninelli, Victor Flores and Andrea Ab – all of the miner’s independent non-executives.

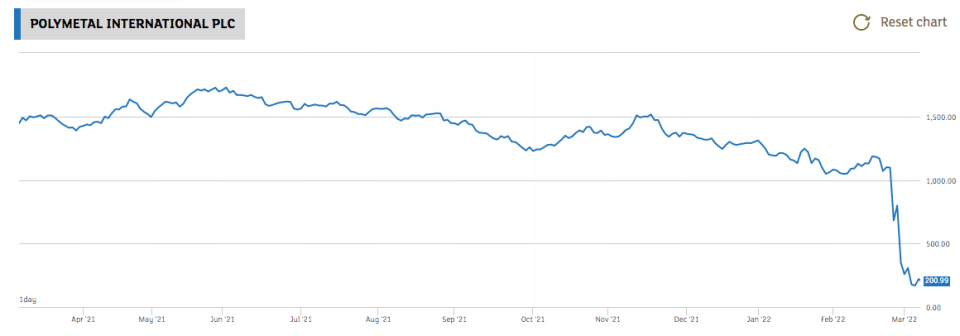

The company has suffered huge losses recently, plunging almost 80 per cent over the past ten days.

The decline in its performance has resulted in the miner being booted off the FTSE 100 alongside Evraz, with both relegated to the lower-level FTSE 250.

Shares in Evraz spiked nearly 30 per cent yesterday, with investors taking a chance on the company, attracted by ultra-low prices in what was a blue chip stock prior to Russia’s invasion.

Bill Browder, chief executive of Hermitage Capital and anti-corruption campaigner, warned people on Sunday to avoid Russian equities, and called on traders to “have some decency.”

In a tweet, he argued asking whether it was acceptable to buy Russian stocks at discount prices was comparable to “asking if you should buy German equities during the Holocaust.”