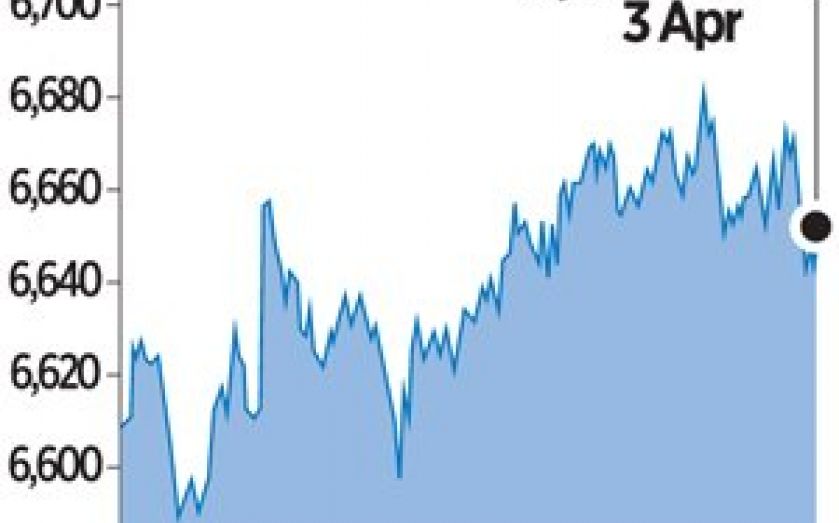

London Report: Shares close down despite dovish ECB and Tullow’s gains

BRITISH blue-chip shares edged lower after testing a three-week high yesterday, as the end of a two-week rally in mining shares offset gains by Tullow Oil.

The session proved volatile, however, with gains made in the afternoon after European Central Bank president Mario Draghi said that action will be taken if the currency union suffers a prolonged period of low inflation.

“The ECB is being slightly more dovish than the market expected,” said Kathy Lien, managing director at BK Asset Management in New York. “The main takeaway is that the council is considering unusual techniques, and that’s negative for euro/dollar.”

The FTSE 100 gave up a 0.2 per cent gain, which took it to its highest since 12 March, to trade 0.2 per cent lower at 6,649.14 at the close, tracking Wall Street into negative territory.

Weaker data from the US came a day ahead of the closely watched non-farm payroll release, and after new Federal Reserve chair Janet Yellen reiterated her easy monetary policy stance.

On the upside, Tullow Oil led the FTSE’s risers with a 6.2 per cent gain.