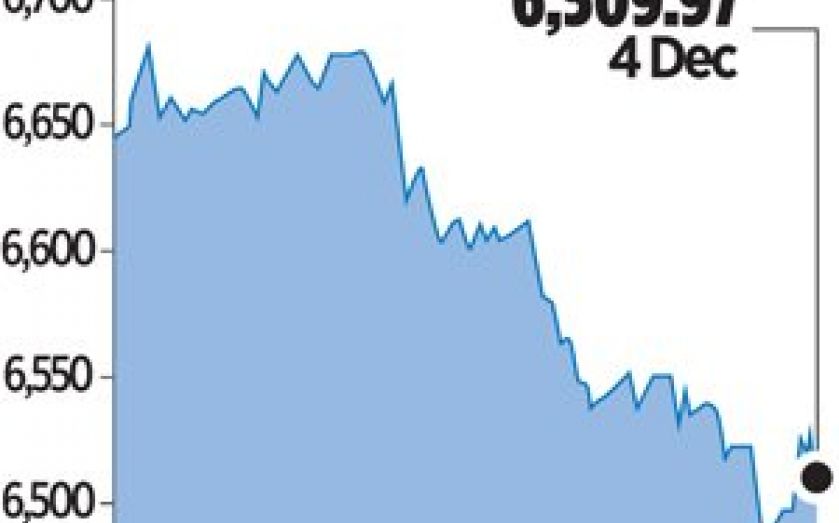

London Report: FTSE tumbles to seven week low on StanChart fall

THE FTSE 100 slipped to seven-week lows yesterday, weighed down by a surprise warning from Standard Chartered that it could be headed for its first drop in profits in a decade.

Shares in the Asia-focused bank fell 6.5 per cent, hitting 16-month lows in volumes more than 4.5 times their 90-day daily average after it said overall results will be hit by losses in Korea.

Although analysts had been cutting estimates for Standard Chartered ahead of the results, overall opinion had been still fairly bullish, with 14 “buy” or “strong buy” ratings, according to StarMine, against six “sell” or “strong sell”.

The steep drop in Standard Chartered alone took about seven points off the FTSE 100. Companies trading without entitlement to the latest dividend – including National Grid and Aberdeen Asset Management – together took off another 3.88 points off the index.

Losses on the benchmark though were limited by a 7.3 per cent rally in Sage. Shares in the software developer jumped to 12-year highs after it posted a sharp rise in take-up for its cloud computing products and raised hopes of a further cash return to shareholders.

The contrasting fortunes of Sage – which increased its dividend by six per cent versus 2012 – and Standard Chartered yesterday underscored both the increasing importance of picking stocks rather than investing in the broader market, as well as continued investor appetite for high-yielding income plays.

“I am concerned a little bit about the returns in the stock market next year,” said Chris White, head of UK equities at Premier Asset Management.

“Generally 2014 I would view as a stock-picking year, where you find good value and good dividend yield.”

The FTSE 100 closed down 22.46 points, or 0.3 per cent, at 6,509.97 points, having recovered from an intra-day seven-week low of 6,479.73 after weaker-than-expected U.S. service sector activity eased concerns about an imminent scaling back of Federal Reserve stimulus.

The index, though, was still down 2.1 per cent so far this week, on track for its biggest three-day drop since June.

Such a retreat has disappointed investors who had been banking on a rise in the index this month in a so-called Santa rally – a trend which has seen the FTSE 100 rise in all but two of the last 20 Decembers, according to Datastream data.