London Report: FTSE shrugs off Barclays rights issue to tick up

UPBEAT earnings from leading companies nudged Britain’s benchmark equity index higher yesterday, enabling the market to offset a slump in Barclays after the bank announced plans for a $9bn capital hike.

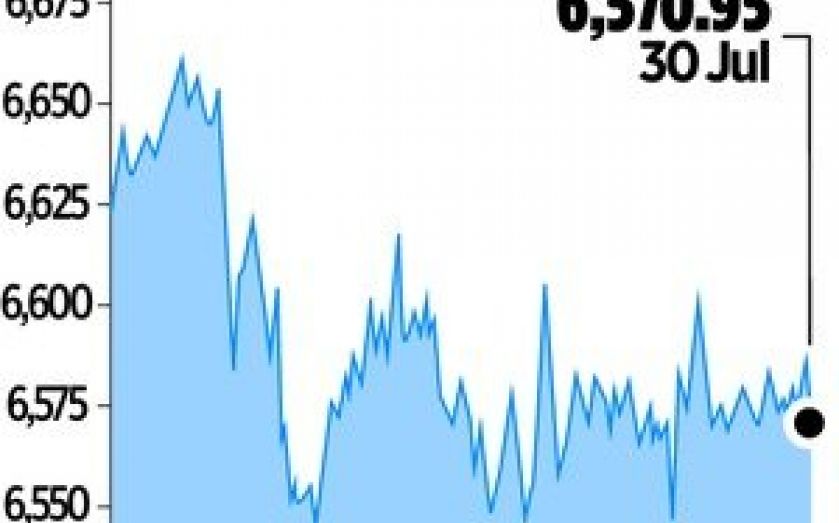

The blue-chip FTSE 100 index closed up 0.2 per cent, or 10.70 points, at 6,570.95.

Engineer GKN topped the leaderboard with a 6.5 per cent rise after better-than-expected interim profits, while media group ITV rose 6.3 per cent after also beating forecasts with its results.

Barclays, however, tumbled 5.7 per cent after announcing plans to raise £5.8bn to strengthen its capital position.

Sucden Financial trader Mike Mason said that while many leading companies had beaten expectations with their results, that had yet to feed through to the broader economy since companies were not necessarily creating jobs.

Still, Citigroup European equity strategist Jonathan Stubbs remained bullish on the FTSE 100, arguing investors should use days when the market fell to buy up stocks on the cheap.

“We stick with our ‘buy the dip’ strategy and target the FTSE at 7,000 at end-2013,” he said.

The blow to Barclays hit other domestic banks, with part-nationalised lenders.

Royal Bank of Scotland and Lloyds fell 2.5 per cent and 1.5 per cent respectively due to worries that they may also have to raise more capital.

“The Barclays news is depressing the banking sector somewhat as fears spread about balance sheet issues,” said Sucden Financial’s Mason.

However, leading global bank HSBC rose 1.1 per cent to add the most points to the FTSE 100.

Hartmann Capital trader Basil Petrides said HSBC had benefited from investors switching out of Barclays and into HSBC.

“It’s better to go into a company with a far stronger capital position, such as HSBC,” he said.

The FTSE 100 hit a 13-year high of 6,875.62 points in late May.

It then fell to 5,897.81 points in June as expectations of a gradual scaling-back of stimulus measures by the US Federal Reserve caused an equities sell-off.

The Fed meets this week and investors will be looking for more clues on when it might start withdrawing stimulus.

The FTSE 100 is still up 11 per cent since the start of 2013.

EGR Broking managing director Kyri Kangellaris said its failure to recapture the highs of May meant the index would not make much headway in the near term.

“The market is struggling to make new highs, which could be a sign of a potential sell-off,” he said.