London Report: Deutsche’s loss knocks the FTSE and UK banks

BRITAIN’S FTSE 100 stalled near an eight-month high yesterday, held back by weak banking shares as a surprise loss at Germany’s Deutsche Bank was seen as a bad omen for UK lenders’ results.

Britain’s main share index, however, was expected to resume its uptrend soon and hit highs not seen since 1999, boosted by a continued flow of money into European shares as the region’s economy improves.

Royal Bank of Scotland and Barclays shed two per cent and 1.3 percent, respectively, after Deutsche Bank announced a pre-tax loss for the fourth quarter.

The German bank blamed the loss on a fall in revenue at its debt-trading divisions as well as costs for litigation and restructuring.

Barclays and RBS, both due to report fourth-quarter earnings next month, derive around 20 per cent and 15 per cent respectively of total group income from trading in fixed income, currencies and commodities (FICC), according to Shore Capital estimates.

Before yesterday’s falls, shares in the two UK banks had risen 6.1 per cent and 7.6 per cent respectively since the start of the year, boosted by healthier prospects for the British economy.

“It would be sensible to expect weak performances from the likes of Barclays and Royal Bank of Scotland in the fourth quarter,” said Shore Capital analyst Gary Greenwood. “The risk (for the stocks) is to the downside given the rise that we’ve had.”

Analysts at Goldman Sachs also warned that so-called non-recurring items such as fines, provisions and charges, have become a persistent feature of UK banks’ results and raise question marks over lenders’ return on equity targets.

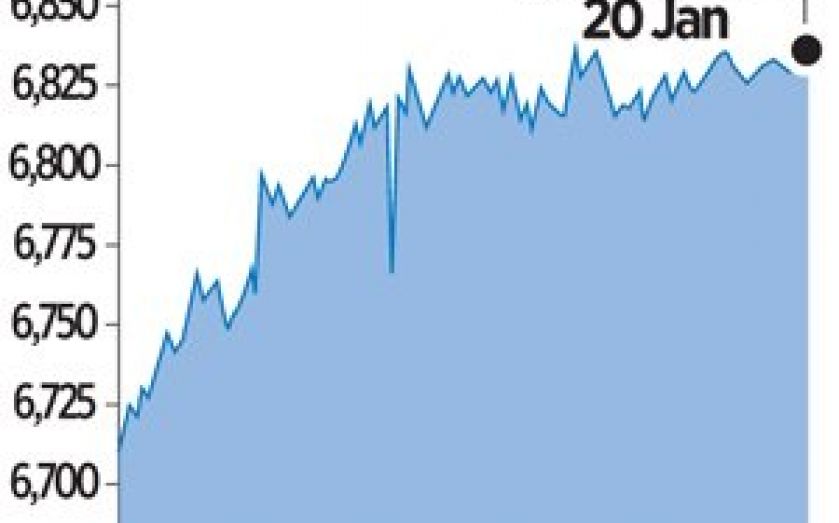

Commercial banks knocked a combined 8.2 points off the FTSE 100, which ended up 7.43 points, or 0.1 per cent, at 6,836.73 points after hitting an eight-month high at 6,840 points on Friday.

The index has risen 1.3 per cent so far this year and is just 0.5 per cent away from a 13-year high of 6,875 hit in May, which in turn is 1 per cent off the index’s all-time peak of 6,950 points, set in late 1999.

Oil and gas engineering firm Weir rose 4.2 per cent after data showed an increase in the number of US natural gas and horizontal rigs.

Gold miners Fresnillo and Randgold were the top FTSE risers as gold hit a six-week high and data showed hedge funds and money managers raised their bullish bets on the metal for a third consecutive week.