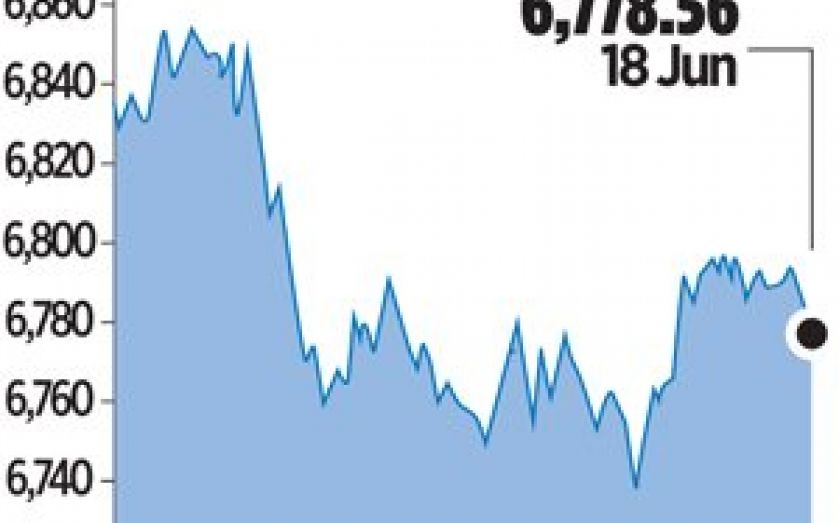

London Report: Concern over oil price pushes up London shares

THE FTSE 100 was up yesterday, with oil companies lifting the market due to high crude prices in the wake of heavy fighting in Iraq, Opec’s second-largest producer.

The index closed up 0.2 per cent, or 11.79 points, at 6,778.56 points.

Brent crude oil rose towards $114 a barrel as Sunni militants pushed forwards in northern Iraq, hitting the country’s biggest refinery at Baiji, near Mosul, and stoking concerns about oil exports as some firms pulled foreign workers out.

Oil firms such as Royal Dutch Shell and BG Group rose 1.6 per cent and 0.8 per cent respectively, helping the UK oil and gas index to gain 1.2 per cent, the top sectoral performer in the FTSE 100 by some margin.

Shire topped the blue-chip leader board, up 2.8 per cent, as bid speculation continued to swirl around the healthcare group.

The company had seen solid gains on Tuesday after sources told Reuters it had hired investment bank Citi as an adviser, expecting to receive takeover approaches.

The FTSE was also held back by United Utilities and Severn Trent as the two companies traded without the attraction of their latest dividend payouts.

Their shares fell by 2.8 per cent and 2.1 per cent respectively.

In the broader market, investors avoided heavy bets ahead of the Federal Reserve’s two-day policy meeting.

After the London markets closed, the US central bank slashed its forecast for US economic growth this year to a range of between 2.1 and 2.3 per cent from an earlier projection of around 2.9 per cent. But its forecasts for 2015 and 2016 were unchanged, and it expressed confidence the recovery was on track. The Fed also pushed ahead with tapering asset purchases, as widely expected.

Separate data released yesterday showed a surprisingly high reading for US inflation.

Cambridge-based digital-printing firm Xaar dropped a further 6.9 per cent to 500p after Tuesday’s profits warning wiped almost a quarter off its shares

Among smaller companies, Premier Foods, the maker of Mr Kipling cakes and Bisto gravy, slid nine per cent after cutting forecast sales for its key brands, blaming a “subdued” grocery market. It promised to cut costs to avoid a fall in profits.